Hospital Chain Bankruptcy: The Case of Steward Health Care and Private Equity Investments

Hospital Chain Bankruptcy: Understanding the Steward Health Care Case

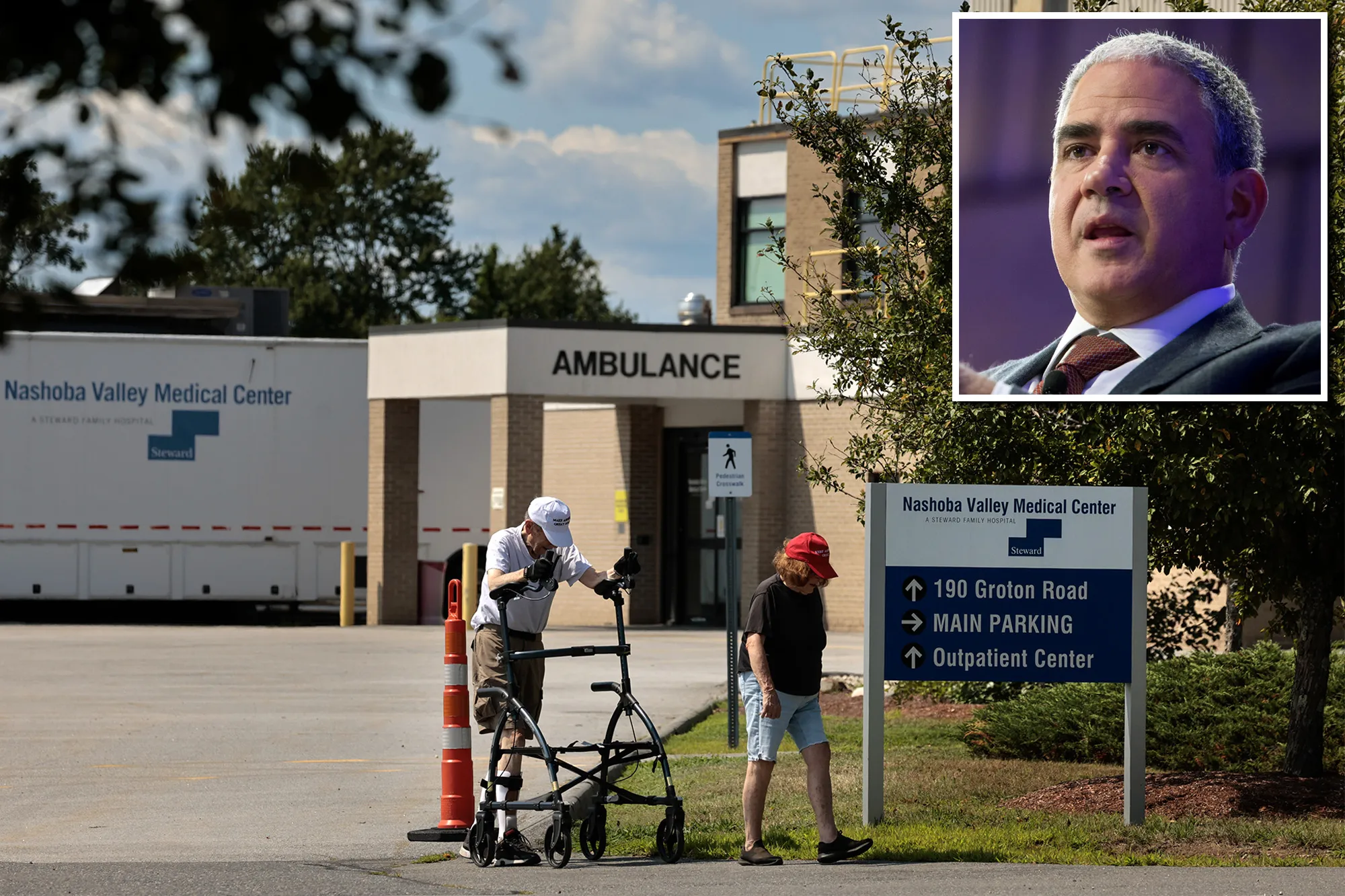

Steward Health Care System, a Boston-based network of 30 hospitals, has found itself in a critical financial position. As it declared bankruptcy, the firm made headlines by paying a substantial $700 million dividend to its private equity investors, despite facing significant losses.

The Role of Private Equity in Healthcare

This situation raises concerning questions about the interests of private equity in the healthcare sector.

- Financial instability of hospitals

- Impacts on patient care

- Long-term sustainability of healthcare systems

Implications for the Industry

The actions of Steward Health Care reflect broader trends within the industry where profitability often supersedes patient-centered care.

- Need for regulatory reforms

- Importance of ethical investment in healthcare

- Proposed measures to protect vulnerable hospitals

Disclaimer: The information provided on this site is for informational purposes only and is not intended as medical advice. We are not responsible for any actions taken based on the content of this site. Always consult a qualified healthcare provider for medical advice, diagnosis, and treatment. We source our news from reputable sources and provide links to the original articles. We do not endorse or assume responsibility for the accuracy of the information contained in external sources.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.