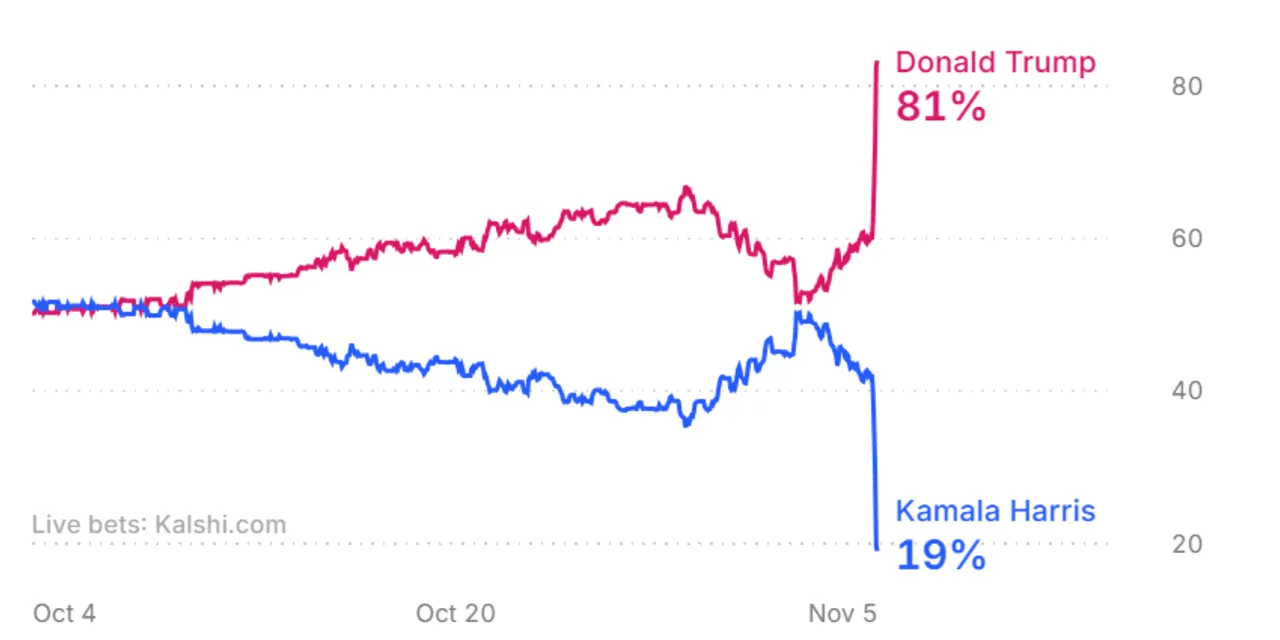

Stock Market Update: Dow Futures Surge 500 Points Amid Trump Election Projections

Stock Market Trends and Predictions

The U.S. dollar demonstrates significant strength against major rivals, notably seeing the Mexican peso and Chinese yuan decline sharply as investors factor in a likely victory for Donald Trump over Kamala Harris in the election. The dollar has risen by 1.5%, reaching 20.32 pesos, a peak not seen in over two years. In relation to the Chinese yuan, it has gained by 1.1%. Trump's previous administration faced China with trade challenges, including tariffs. Reports indicate that Trump has threatened to impose further tariffs unless action is taken to halt fentanyl exports to the U.S.

Market Reactions

- Investors are recalibrating strategies based on election forecasts.

- The U.S. dollar's performance directly influences market movements.

- Threats of tariffs could impact international trade relations.

For ongoing updates regarding the stock market or health-related trends, stay tuned.

Disclaimer: The information provided on this site is for informational purposes only and is not intended as medical advice. We are not responsible for any actions taken based on the content of this site. Always consult a qualified healthcare provider for medical advice, diagnosis, and treatment. We source our news from reputable sources and provide links to the original articles. We do not endorse or assume responsibility for the accuracy of the information contained in external sources.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.