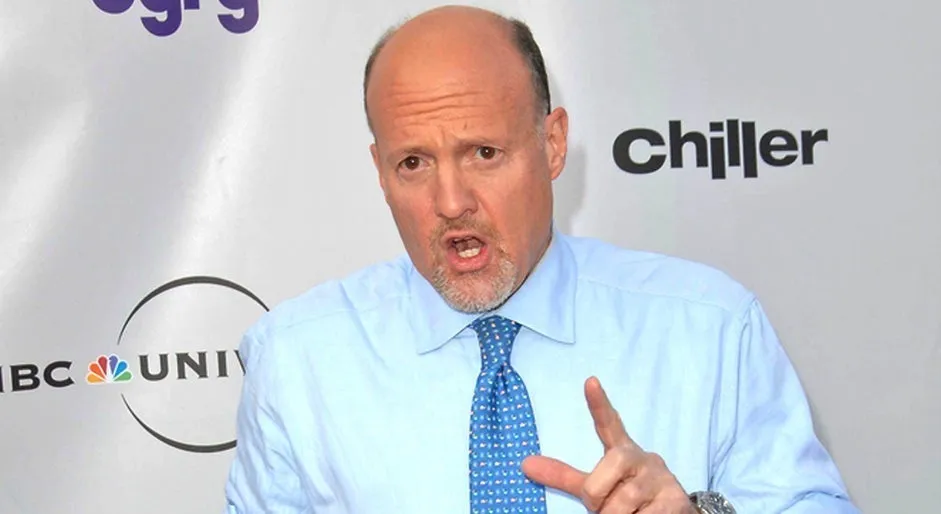

GameStop Needs a Banking Model, Says Jim Cramer

GameStop's Future: Banking or Bust?

Jim Cramer has recently pointed out the critical need for GameStop to explore operating as a bank to adapt to changing retail landscapes. Cramer, echoing sentiments from industry analysts, believes the time has come for GameStop to consider closing physical stores and focus on adopting a banking model. This shift could potentially open avenues for additional revenue streams and investment strategies that could revitalize the company's financial standing.

- Massively Overvalued: Cramer labels the stock overpriced, drawing attention to its speculative nature.

- Market Trends: There’s a growing consensus among investors about needing structural changes.

- Acquisitions: Many are hopeful that strategic acquisitions could boost GameStop's stock value.

What This Means for Investors

Investors following GameStop should carefully consider these insights as they might influence future market movements. As seen with other companies adapting to new models, a proactive stance could be what GameStop requires to maintain its market relevance.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.