Biren Technology Navigates GPU US Sanctions in Pursuit of AI Chip IPO

Impact of GPU US Sanctions on Biren Technology

Biren Technology, a prominent player in the AI chip sector, is preparing for a significant IPO despite GPU US sanctions presenting substantial hurdles. The company has engaged Guotai Junan Securities for IPO-related guidance following its valuation at US$2.19 billion. This IPO preparation, known as ‘tutoring’, is a prerequisite in the Chinese market.

Challenges and Opportunities for Biren

The Chinese tech landscape has seen overwhelming unicorn valuations in the integrated-circuit industry, according to a report by Great Wall Strategy Consultants. However, reliance on state-backed investments poses systemic risks, as noted by renowned banker Fang Fenglei.

Backing and Production Woes

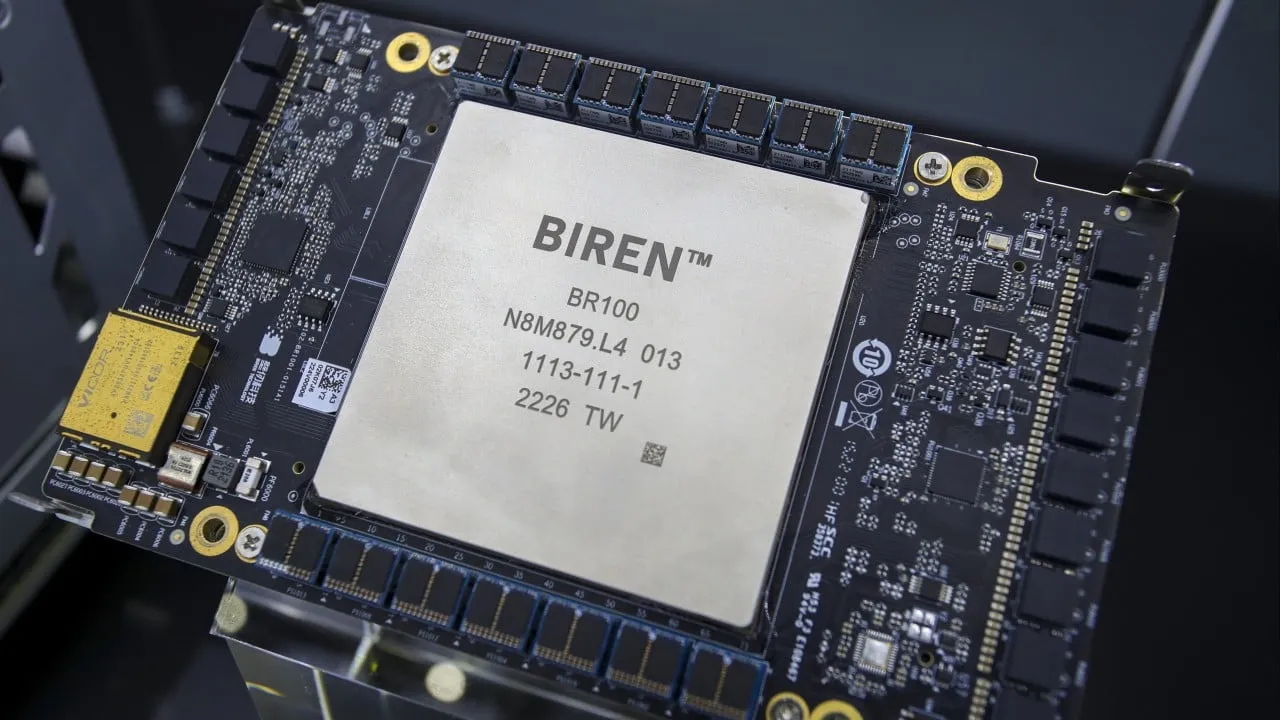

Biren, supported by venture capital firm HongShan, has amassed over US$780 million to date. Yet, US sanctions imposed by the Commerce Department inhibit access to crucial manufacturing resources, specifically hobbled collaborations with Taiwan Semiconductor Manufacturing Company. As the competitive landscape heats up, Biren launched its pioneering BR100 GPU in August 2022, gaining international traction and marking its place in the industry.

Conclusion: Biren's Path Forward

This scenario highlights the intricate dance between sanction pressures and technological ambitions within China's burgeoning AI chip market. Biren’s success in the IPO endeavor could redefine its trajectory and the broader industry.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.