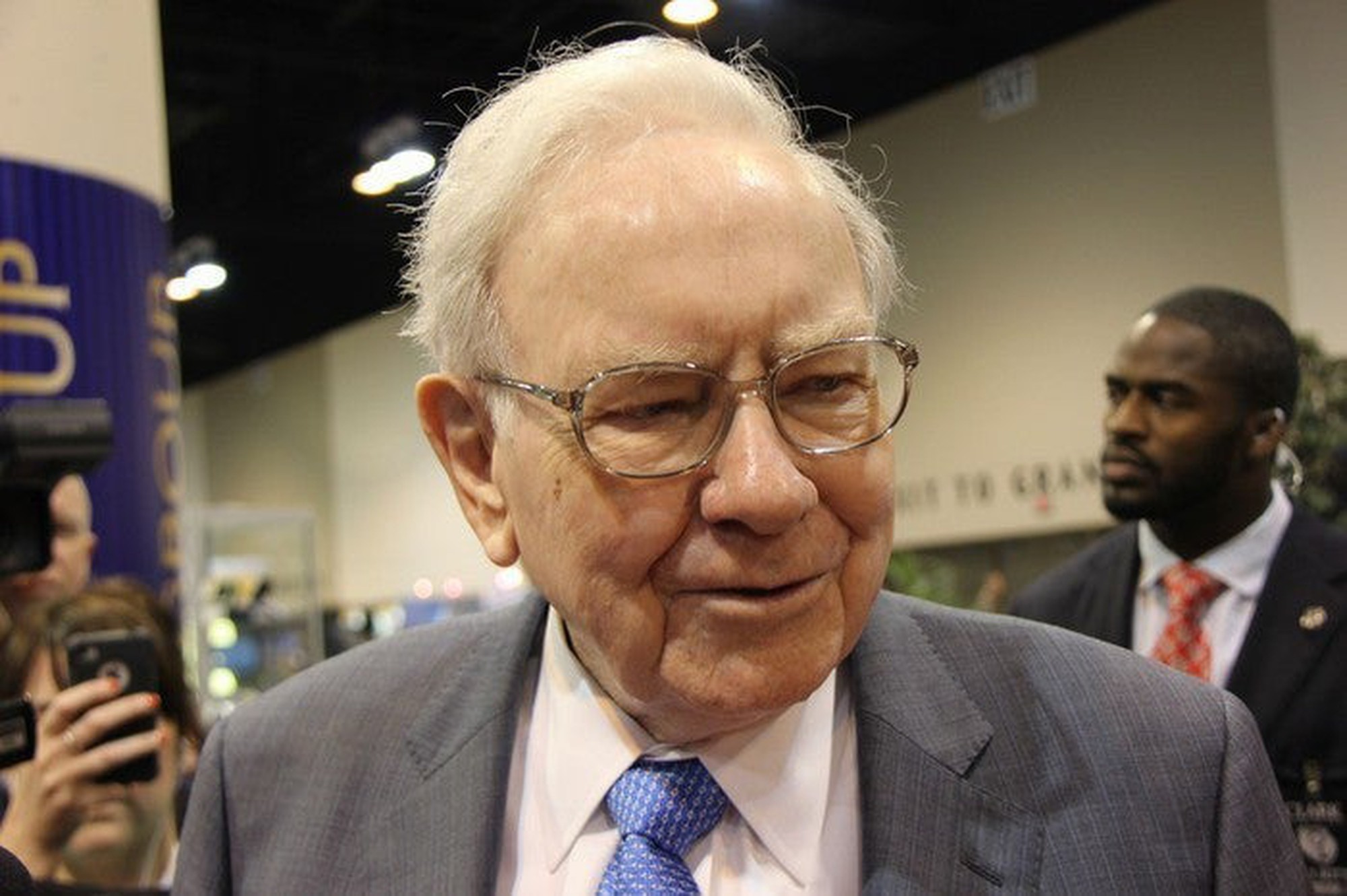

Buffett's Investment Insight: Why Chubb Stands Out as Berkshire Hathaway's New Asset

Favorable Environment for Insurers

Buffett buys into industry-leading insurance brand, Chubb Limited, benefiting from a robust insurance market.

- Influence of Severe Weather: Hurricanes and other natural disasters triggered market transformation in 2017, reshaping insurance rates and terms.

- Impact of Inflation and Interest Rates: Social and economic inflation post-pandemic, coupled with rising interest rates, have intensified market dynamics.

- Profitability and Valuation: Chubb's market performance, high profit margins, and low valuation multiples position it as an attractive investment.

Chubb Fits with Buffett's Investment Strategy

Buffett's interest in Chubb underscores the insurer's alignment with Berkshire's focus on premium brands and quality services.

- Customer-Oriented Approach: Chubb's customer-centric operations drive its reputation for generous claims handling and premium pricing.

- Underwriting Excellence: Chubb's consistent underwriting margins and market share in high-net worth segments reflect its industry leadership.

Potential for Full Acquisition by Berkshire

Speculation arises on Berkshire Hathaway's possible acquisition of Chubb, fueled by Buffett's strategic portfolio expansion and available cash reserves.

- Strategic Fit: Chubb's property & casualty offerings complement Berkshire's existing insurance empire, paving the way for a synergistic acquisition.

- Growth Prospects: Investment in Chubb could yield substantial returns if Berkshire pursues acquiring the entire company, highlighting short-term gain potential.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.