Business and Corporate Crime: Fed Official Ethics Violation Uncovered in U.S. News

Corporate Crime and Ethics Violations

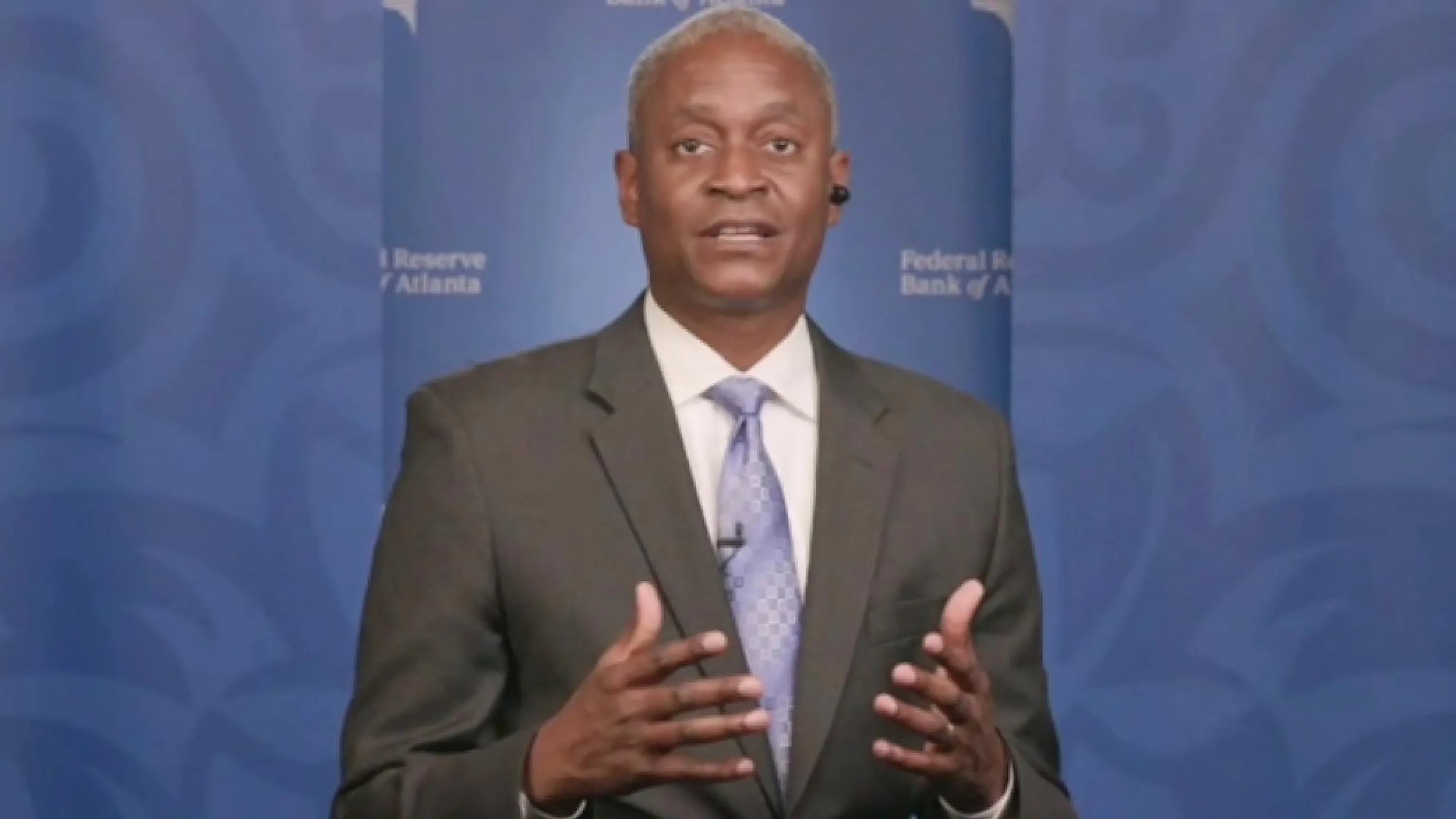

A recent investigation by government authorities has illuminated the ethical missteps of Atlanta Federal Reserve President Raphael Bostic. While his actions raised eyebrows within the financial community, they did not cross the legal boundaries set for insider trading.

Key Findings of the Inquiry

- Bostic's trades breached multiple ethics policies.

- No insider trading laws were violated.

- The implications for corporate governance are significant.

With such violations, we see a pertinent discussion around maintaining integrity in the finance sector and which rules are crucial for preventing corporate crime.

Implications for Future Conduct

- Uphold ethical standards: Financial leaders must ensure compliance with all established guidelines.

- Monitor securities trades: Regular audits could prevent similar situations.

- Engage in transparency: Trust in financial institutions hinges on public accountability.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.