Business Insights: Bankrupt Hospitals and Private Equity Investments

Understanding the Impact of Private Equity on Hospitals

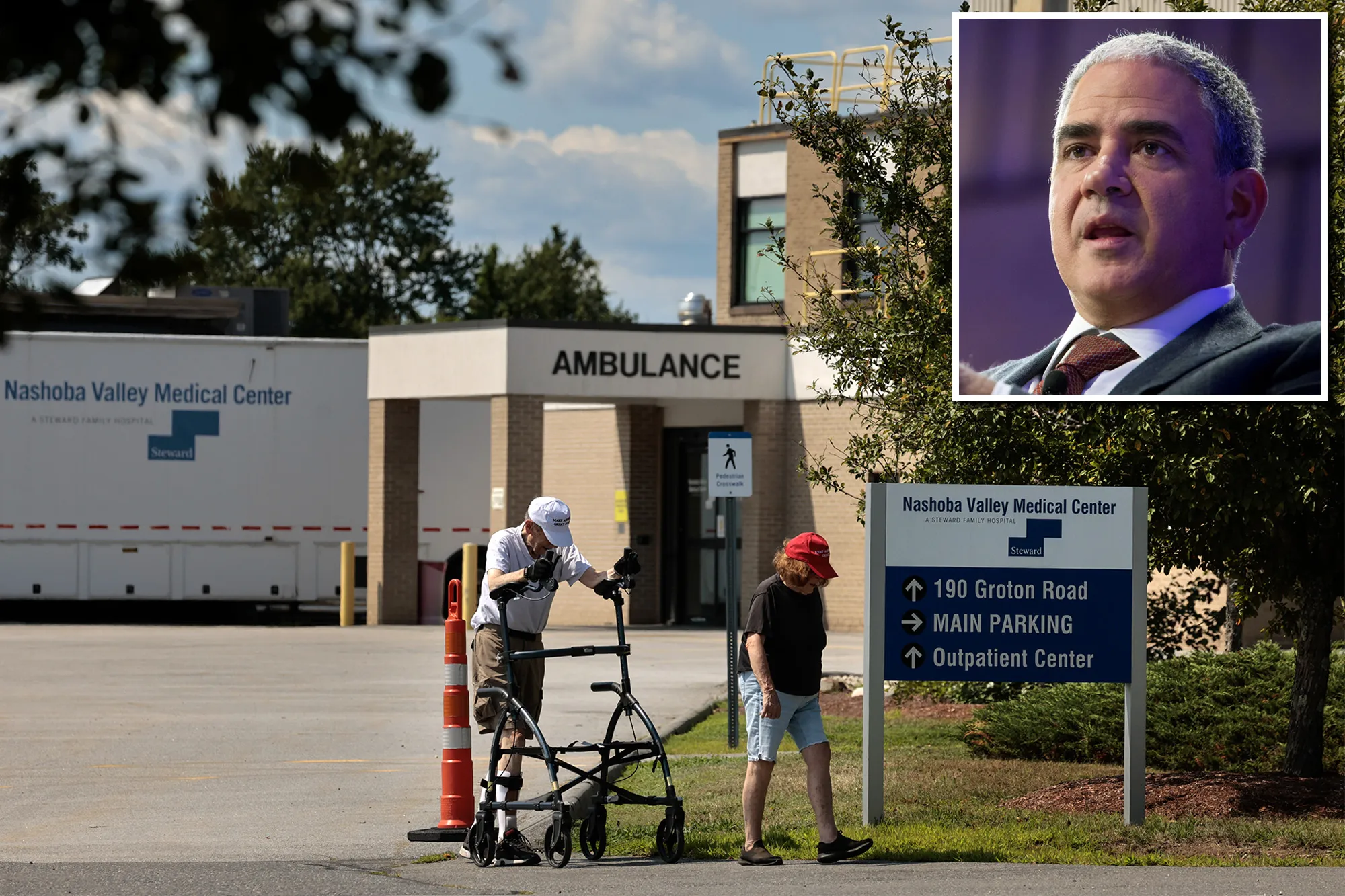

In recent news, several bankrupt hospitals, including Steward Health Care System, have made headlines by allocating significant funds as dividends to private equity investors. Despite the financial struggles these institutions face, paying out a hefty $700 million has introduced a wave of skepticism about the financial practices within the healthcare sector.

Overview of Steward Health Care System

- Location: Boston, operating across 30 hospitals

- Focus: Rural and low-income healthcare

- Current Status: Recently declared bankruptcy

Private Equity's Role in Hospitals

Private equity investments in healthcare often promise growth and efficiency. However, the recent trends show a contradictory narrative. The decision by bankrupt hospitals to continue lucrative deals with private equity raises pertinent questions about the long-term vision for healthcare delivery and patient care.

Future Implications for Healthcare

- The sustainability of hospital operations may be compromised.

- High dividends paid to private equity could affect patient services.

- Regulations around private equity in healthcare might become stricter.

Stakeholders must remain vigilant as the intersection of business, private equity, and healthcare continues to evolve, shaping the future of public health access and quality.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.