IonQ Stock: Evaluating the Risks and Opportunities

Current Landscape of IonQ Stock

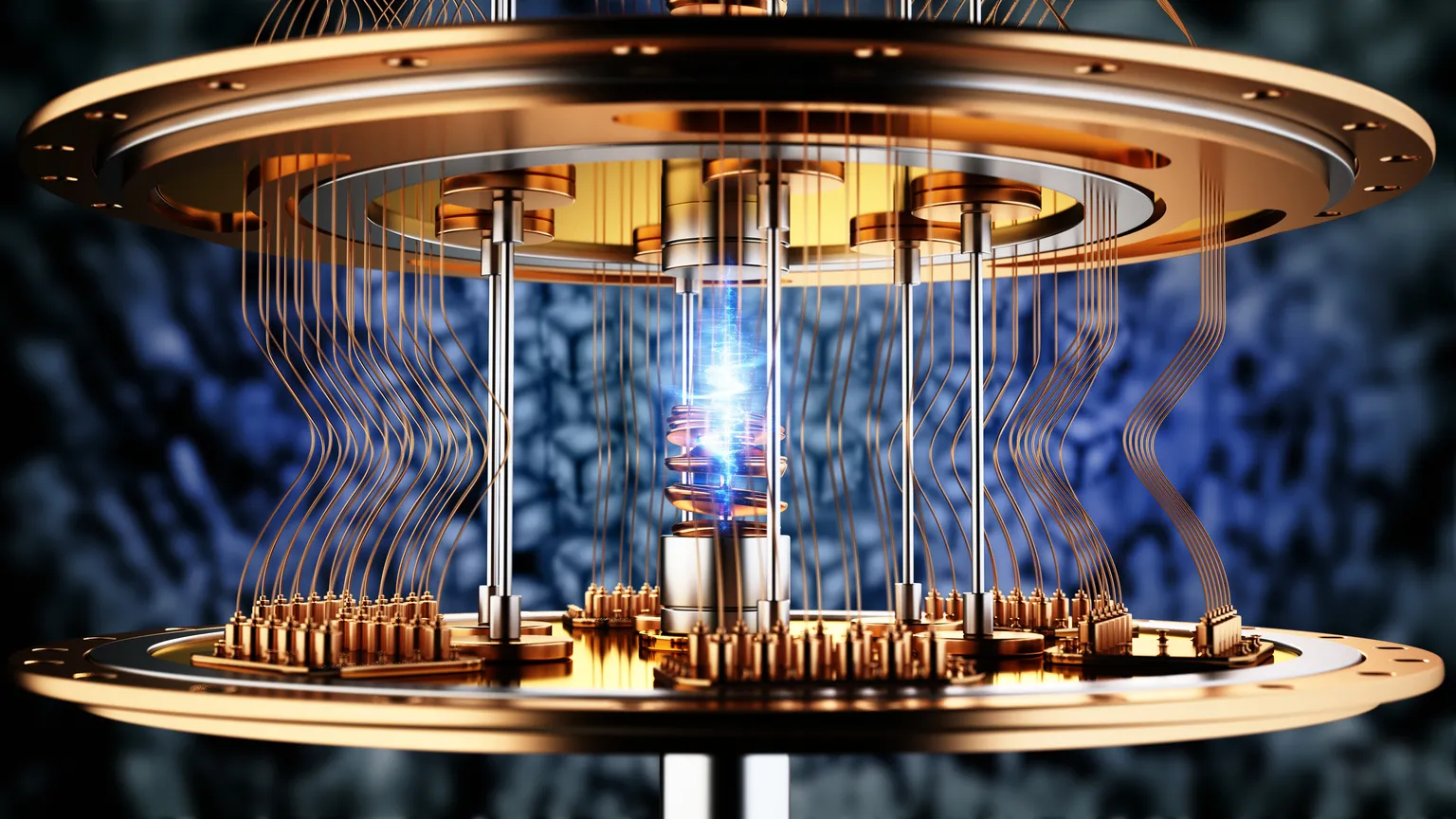

Investors are eyeing IonQ stock closely as it navigates the quantum computing landscape. The company has achieved remarkable technical achievements, positioning it as a leading player. However, the financial health raises red flags.

Cash Burn versus Revenue

One major concern for investors is the high cash burn rate, which significantly overshadows its current revenue generation. This financial strain could affect the company’s operational viability in the near term.

Future Prospects

The future of IonQ stock hangs in a delicate balance, as ongoing developments could influence its performance. Investors should remain cautious and closely monitor these dynamics.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.