Exploring the Potential of Tokenisation in Unlocking Dormant Collateral

The Power of Tokenisation in Financial Markets

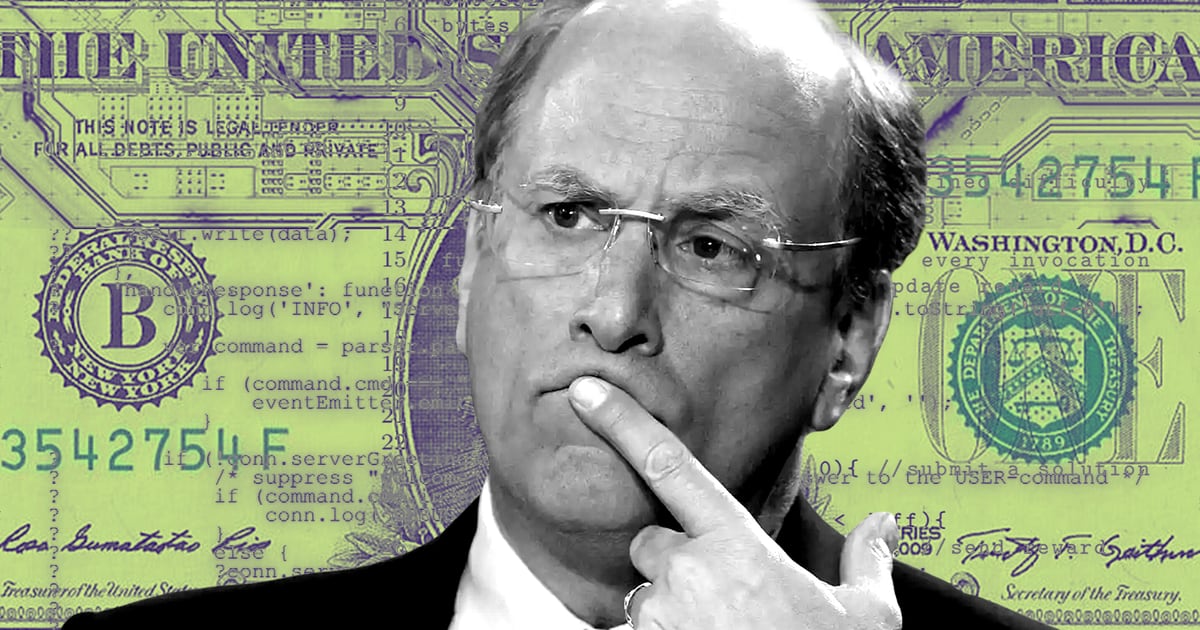

Tokenisation, the process of trading financial instruments on a blockchain platform, has the potential to unlock a massive $19 trillion in dormant collateral. This innovative approach is gaining momentum in the financial sector, introducing new avenues for capital efficiency and liquidity.

Benefits of Tokenisation

- Unlocking Value: Tokenisation enables the utilization of dormant collateral, bringing previously untapped resources into circulation.

- Efficiency and Transparency: By operating on a blockchain, tokenisation offers increased efficiency and transparency in trading financial instruments.

This represents a monumental shift in the financial landscape, with the potential to revolutionize how collateral is leveraged in the market.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.