Colorado Department of Revenue Highlights Unclaimed Tax Credits for Residents

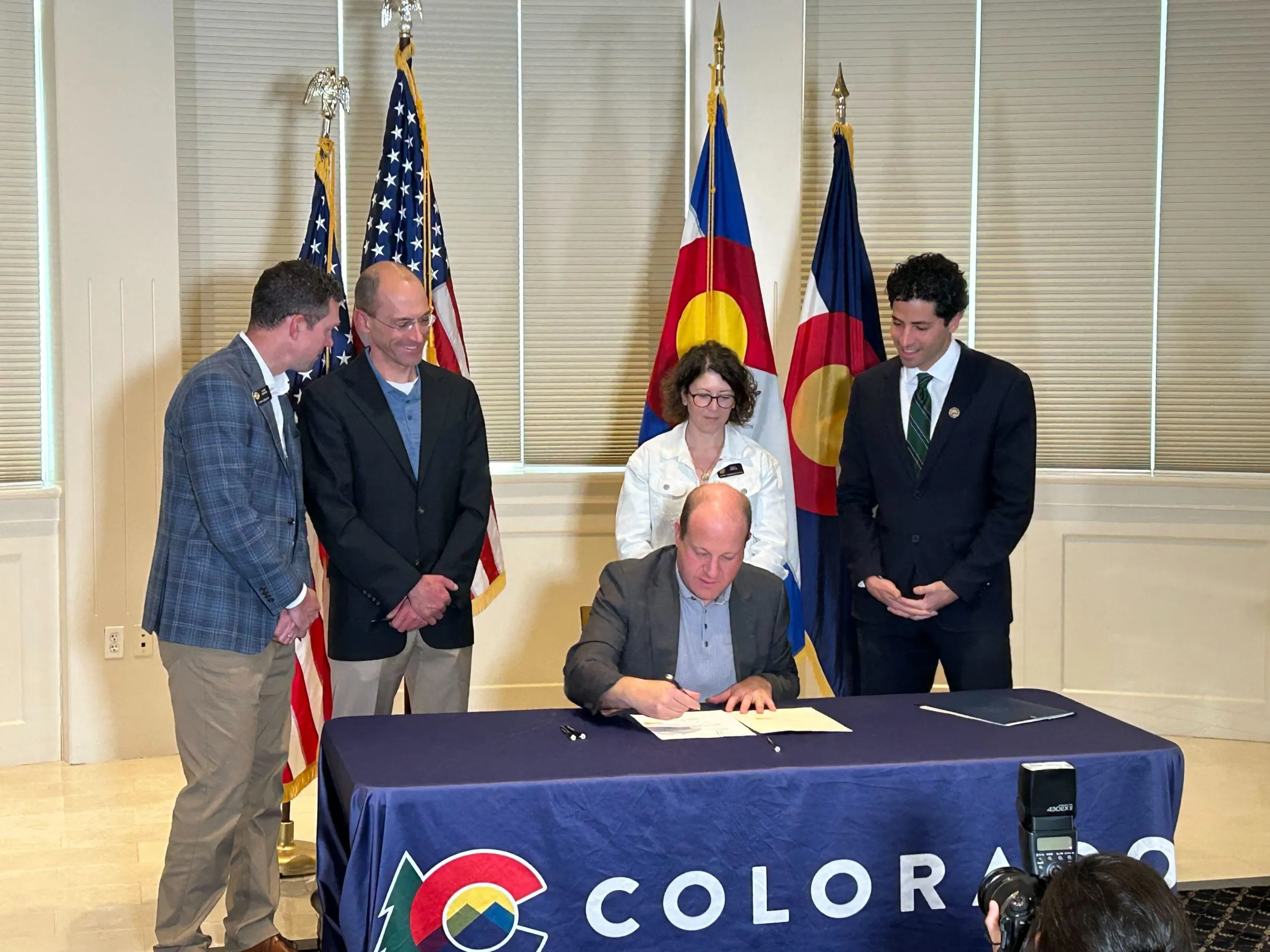

Transforming Financial Support: Colorado's New Tax Credit Law

Every year, millions in tax breaks remain unclaimed in Colorado. The Colorado Department of Revenue is taking action to change that with a new law aimed at facilitating access to these valuable resources.

Understanding the Financial Impact

These tax credits play a vital role in providing financial relief for families, particularly those struggling with poverty. The initiative targets unclaimed benefits that can significantly enhance the household budget and improve quality of life.

- Tax Breaks crucial for economic stability

- Improving access to tax credits vital for community growth

- Targeting unclaimed funds empowers families

Key Benefits of Tax Credits

- Enhanced Financial Security for Families

- Increased local spending and investment

- Reduction in poverty levels due to better resource access

In summary, the Colorado Department of Revenue is passionately advocating for increased awareness of tax credits and breaks that families deserve. This law not only seeks to reclaim lost funds but also aspires to transform financial landscapes for many Coloradans.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.