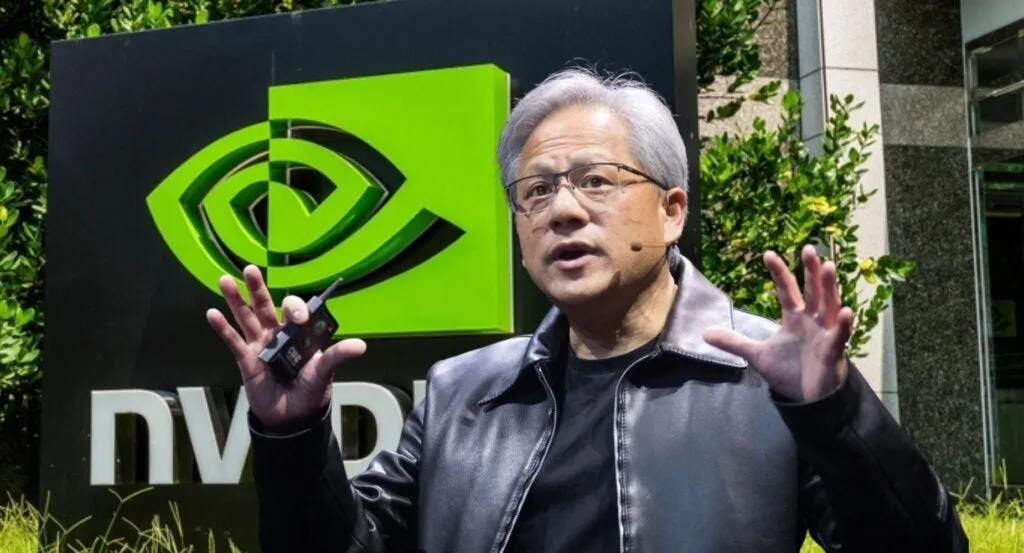

Nvidia Investor Scrutiny Over Blackwell Chip Delays Raises Revenue Concerns

Nvidia Faces Investor Scrutiny Over Blackwell Chip Delays

Nvidia, the leading graphics processing unit manufacturer, is currently facing significant investor scrutiny over delays in the rollout of its Blackwell chip. As stakeholders look toward the upcoming Goldman Sachs conference, concerns have been raised regarding potential revenue impacts stemming from these setbacks.

Potential Revenue Implications

Analysts are increasingly vocal about their worries, suggesting that untimely launches could hinder Nvidia's competitive stance in the technology market. With companies such as Taiwan Semiconductor (TSM) in the mix, investors are eager for updates on operational solutions and product timelines.

Key Takeaways for Investors

- Blackwell Chip Delays: Impacting market expectations and investor confidence.

- Goldman Sachs Conference: A critical platform for updates and future guidance.

- Market Response: Stakeholders must remain agile in light of shifting circumstances.

As Nvidia navigates through this challenging landscape, the attention of the financial community remains calibrated on its upcoming market performance announcements.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.