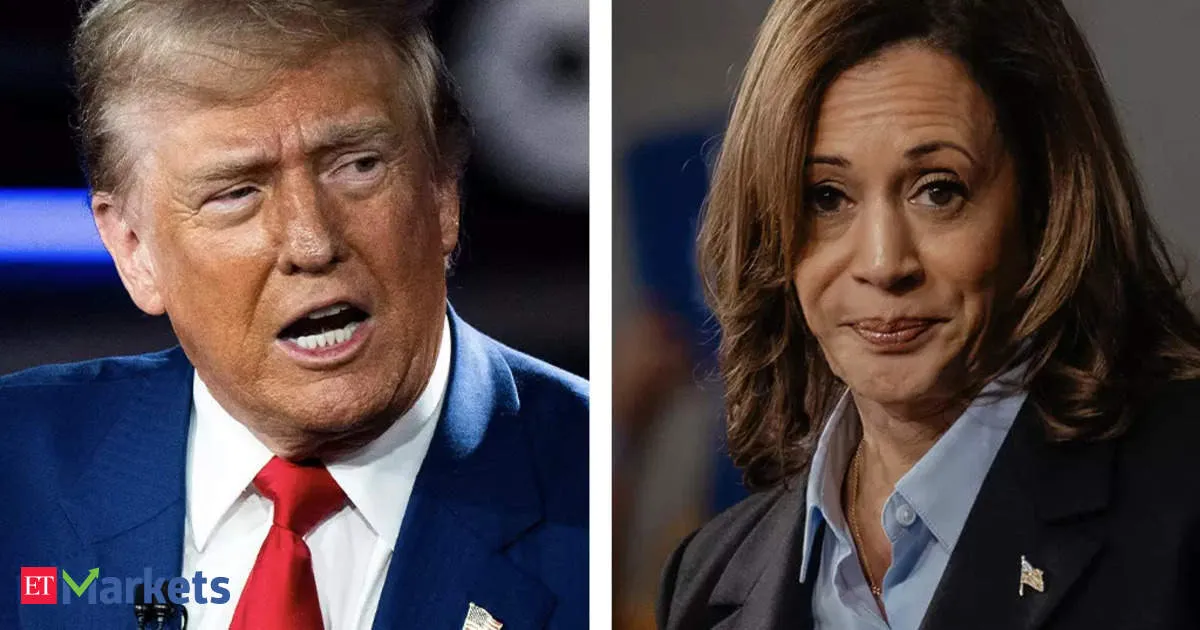

Equity Analysis on the Impact of Monetary Policy and Implied Volatility Amidst the Trump-Harris Debate

Impact of the Debate on Equity Analysis

As the Trump-Harris debate approaches, investors are acutely aware of the implications for equities, monetary policy, and implied volatility. Recent analysis shows that election-related uncertainties are causing significant fluctuations in the market. Volatility measures have surged, indicating a nervous sentiment ahead of the critical debate.

Key Areas of Focus for Equity Investors

- Tax and Tariffs: Candidates' positions on these crucial subjects may lead to radical shifts in equity performance.

- Market Reactions: Indicators point to a possible increase in investor activity as election outcomes become clearer.

Monetary Policy and Market Sentiment

The Federal Reserve's interest rate decisions remain a pivotal concern. Predictions suggest that irrespective of the election's outcome, fiscal pressures are expected to grow, affecting bond yields and currency valuations.

Implied Volatility Trends

- Historical data indicates that debates often coincide with spikes in implied volatility as traders brace for potential policy shifts.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.