30-Year Mortgage Rates Analysis: Trends Leading to a 19-Month Low

Understanding the Current Trends in 30-Year Mortgage Rates

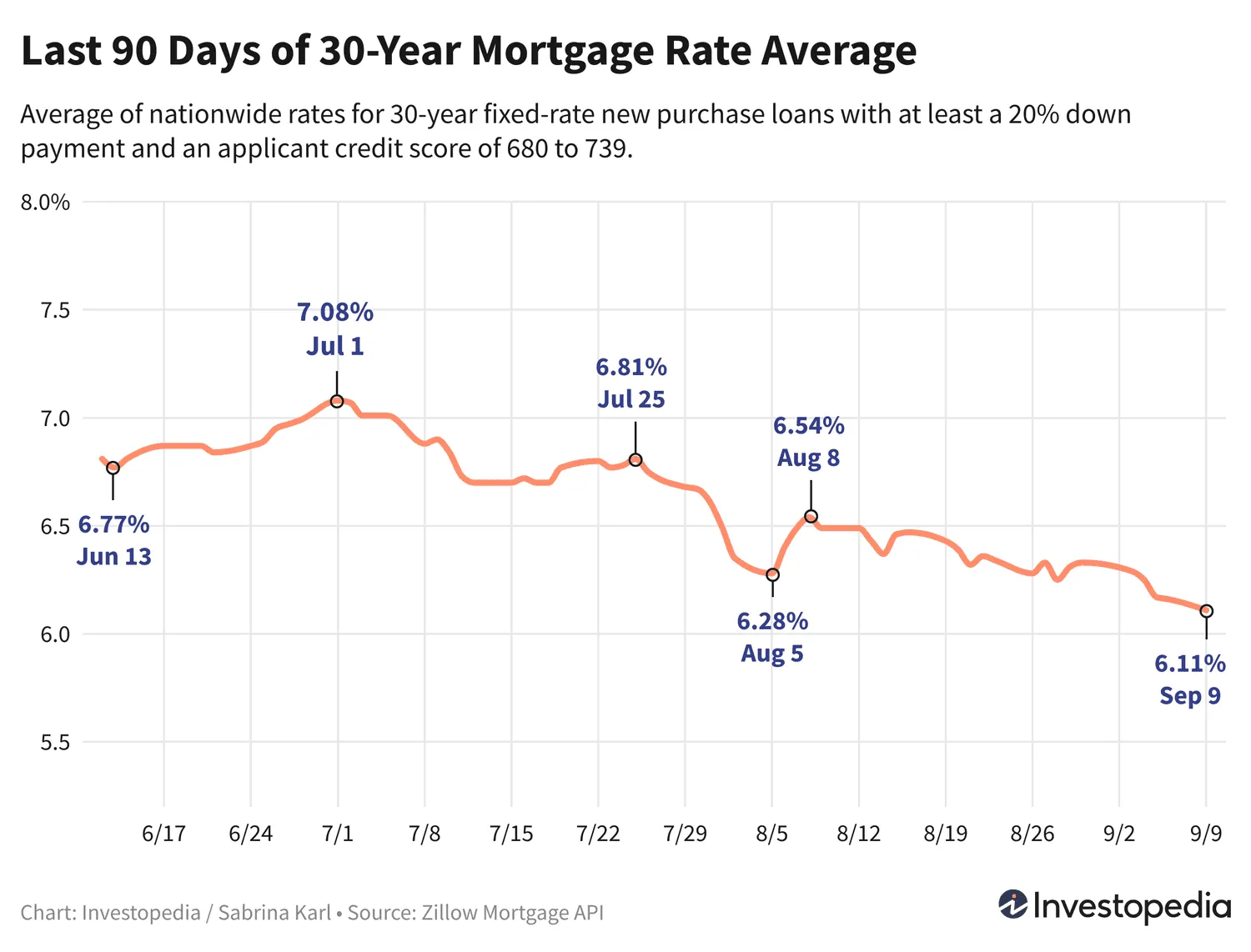

30-Year mortgage rates have been consistently decreasing, and as of September 10, 2024, they have fallen to a 19-month low. This significant drop can be attributed to various economic factors, including lower inflation rates and shifting monetary policies.

Factors Influencing the Decline

- Economic Policies: Recent adjustments in federal reserve strategies aimed to stabilize the economy.

- Housing Market Dynamics: A softer housing market has also contributed to the decline in mortgage rates.

- Consumer Trends: There is an increasing willingness among potential homebuyers to take advantage of lower rates.

What This Means for Homebuyers

For homebuyers, this presents an enticing opportunity to secure favorable financing conditions. Economic signals suggest that continued low rates might persist, attracting more buyers into the market.

Key Takeaways on Mortgage Rates

- Current Rate Landscape: Understanding the ongoing low rates could benefit prospective homeowners.

- Market Predictions: Analysts predict potential fluctuations in the future depending on market conditions.

For more detailed insights into the mortgage rates and their implications, please visit our source.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.