Gold Price Forecast: Analyzing Market Trends and Demand Dynamics

Gold Price Forecast: Current Market Analysis

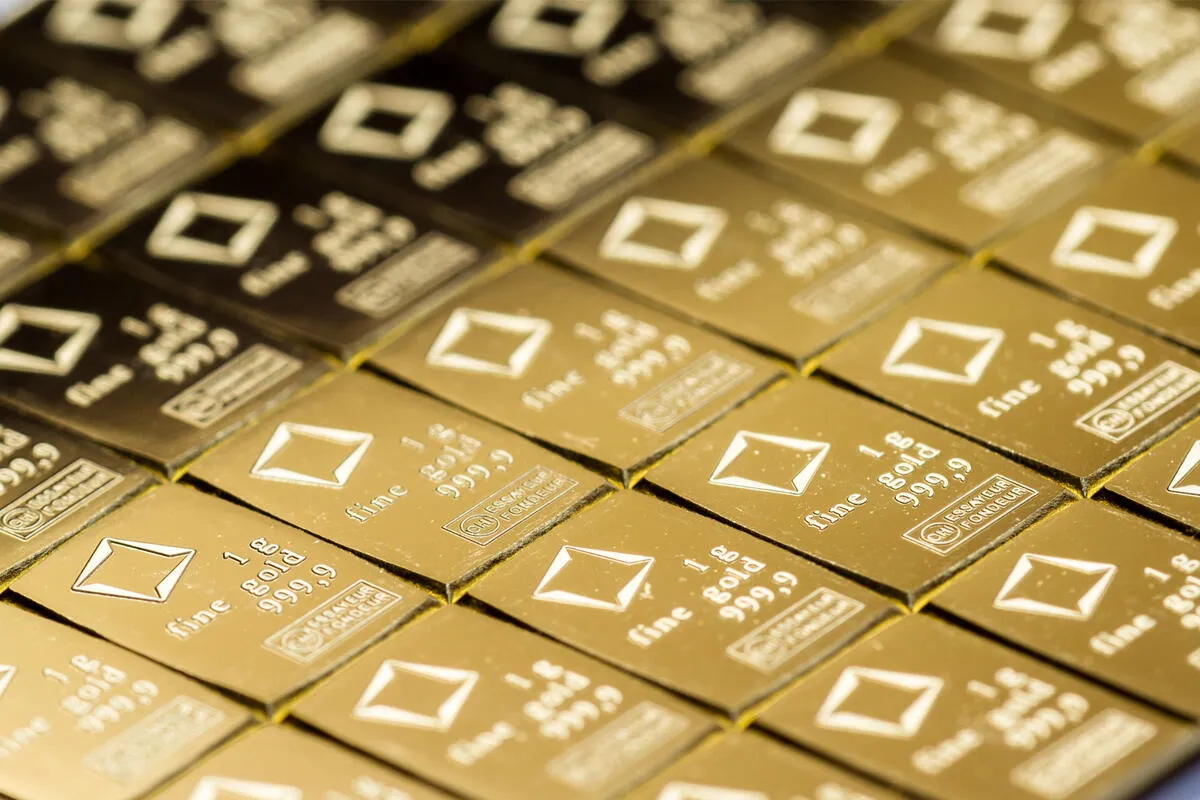

The gold market initially pulled back but has shown signs of strength. The $2,500 level continues to be a significant support area. With a strong uptrend in place, we anticipate further gains.

Market Dynamics

- Resistance Level: A break above $2,530 could signal substantial upward movement.

- Geopolitical tensions are resulting in persistent demand for gold.

- Falling interest rates increase gold's attractiveness over paper assets.

As major economies like India, China, and Russia purchase gold aggressively, the outlook remains positive. Short-term pullbacks can be seen as buying opportunities, particularly with a target of $2,600 in sight.

Future Considerations

- Monitor geopolitical developments.

- Watch for trends in interest rates.

- Track purchases from major economies.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.