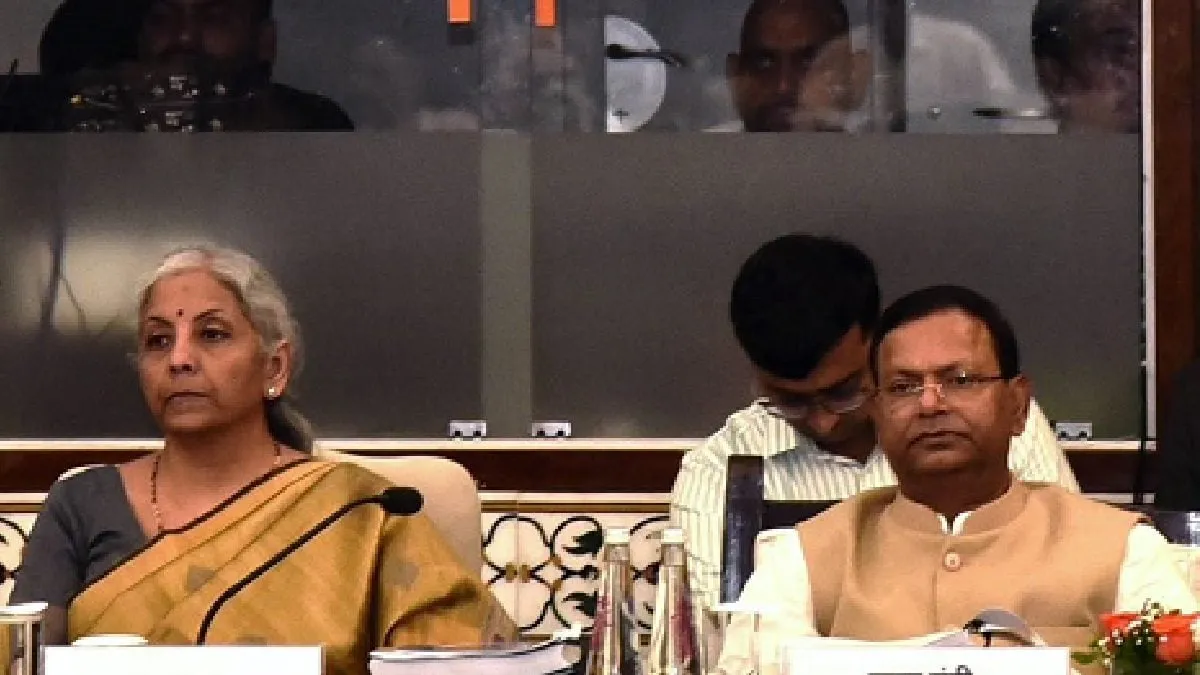

54th GST Council Meeting Update: Major Tax Reforms Unveiled

Major Outcomes from the 54th GST Council Meeting

The GST Council meeting today revealed a series of vital updates following the 54th GST Council meeting. There is a clear consensus to reduce taxes on health insurance premiums and cancer drugs, particularly Trastuzumab Deruxtecan, Osimertinib, and Durvalumab, seeing a tax reduction from 12% to 5%. This change is significant for the healthcare sector.

Establishment of New Groups of Ministers

- The Council has initiated the formation of two new Groups of Ministers (GoM) to tackle complexities in health insurance and the GST compensation cess.

- The GoM on compensation cess will advise on the path forward once the loans for revenue shortfalls from the pandemic are cleared.

Tax Rate Adjustments

Several key adjustments in tax rates were announced:

- Reduction on certain food items like namkeen from 18% to 12%.

- Increase on car seats from 18% to 28%.

- GST on helicopter passenger transport will be 5% with 18% on chartering.

Expert Reactions

Experts are weighing in on these changes:

- Mahesh Jaising of Deloitte highlighted the response to issues around group insurance and noted the clarity provided to states regarding the compensation cess.

- Jasmine Damkewala expressed concerns about the taxation on online transactions under Rs 2,000, arguing it counteracts digitalisation efforts.

As the GST Council meeting updates unfold, the focus remains on aligning reforms with broader economic objectives while mitigating adverse effects on businesses and consumers.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.