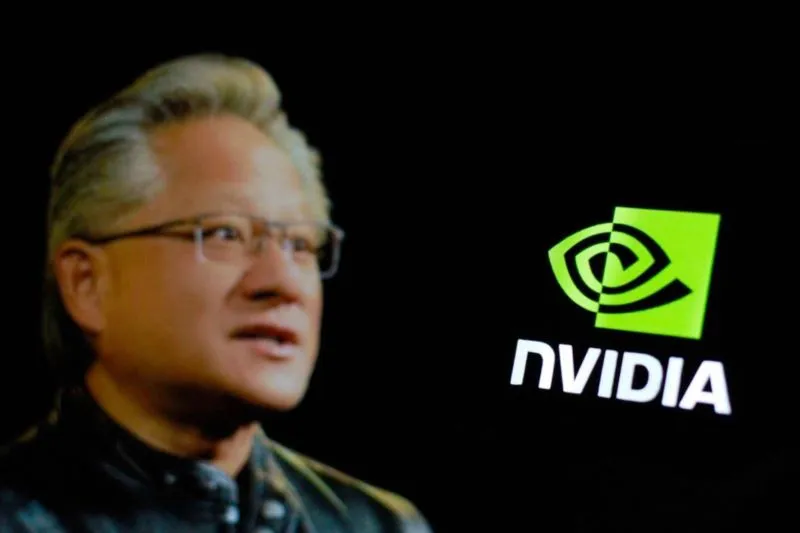

Nvidia Stock Faces Selling Pressure Amid Insider Trading Alerts

Nvidia Faces Insider Trading Alerts Affecting Stock Performance

Nvidia's recent stock sell-off has triggered alarm bells, especially following CEO Jensen Huang's significant NVDA stock sales, totaling over $53 million. Huang sold 240,000 shares worth approximately $27.57 million and another 240,000 on September 5 for around $25.81 million. This brings his total NVDA stock sales since June to nearly $680 million.

Market Impact of Nvidia's Stock Sales

The selling spree coincides with Nvidia losing about $400 billion in market value last week, marking the worst September start since 1953. Despite this, Goldman Sachs analysts, led by Toshiya Hari, continue to endorse Nvidia with a ‘buy’ rating, asserting the sell-off was overblown.

- Current NVDA Stock Price: $106.47

- 7-Day Decline: 8.23%

- YTD Growth: 121.03%

Future Prospects for Nvidia

Looking ahead, Nvidia is optimistic about generating over $3 billion in revenue in Q4 2025, bolstered by its upcoming Blackwell product launch. This could provide a significant boost, even amidst challenges like a subpoena from the US Department of Justice due to an antitrust investigation.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.