Tech Startups: PastPay Secures $13.3 Million in VC Funding for BNPL Solutions

Fintech Innovations: A Game Changer for Startups

PastPay, a Hungarian startup making waves in the fintech sector, provides businesses with a buy-now, pay-later (BNPL) option for their invoices. With a recent Series A funding round of $13.3 million, PastPay aims to enhance the payment experience for merchants.

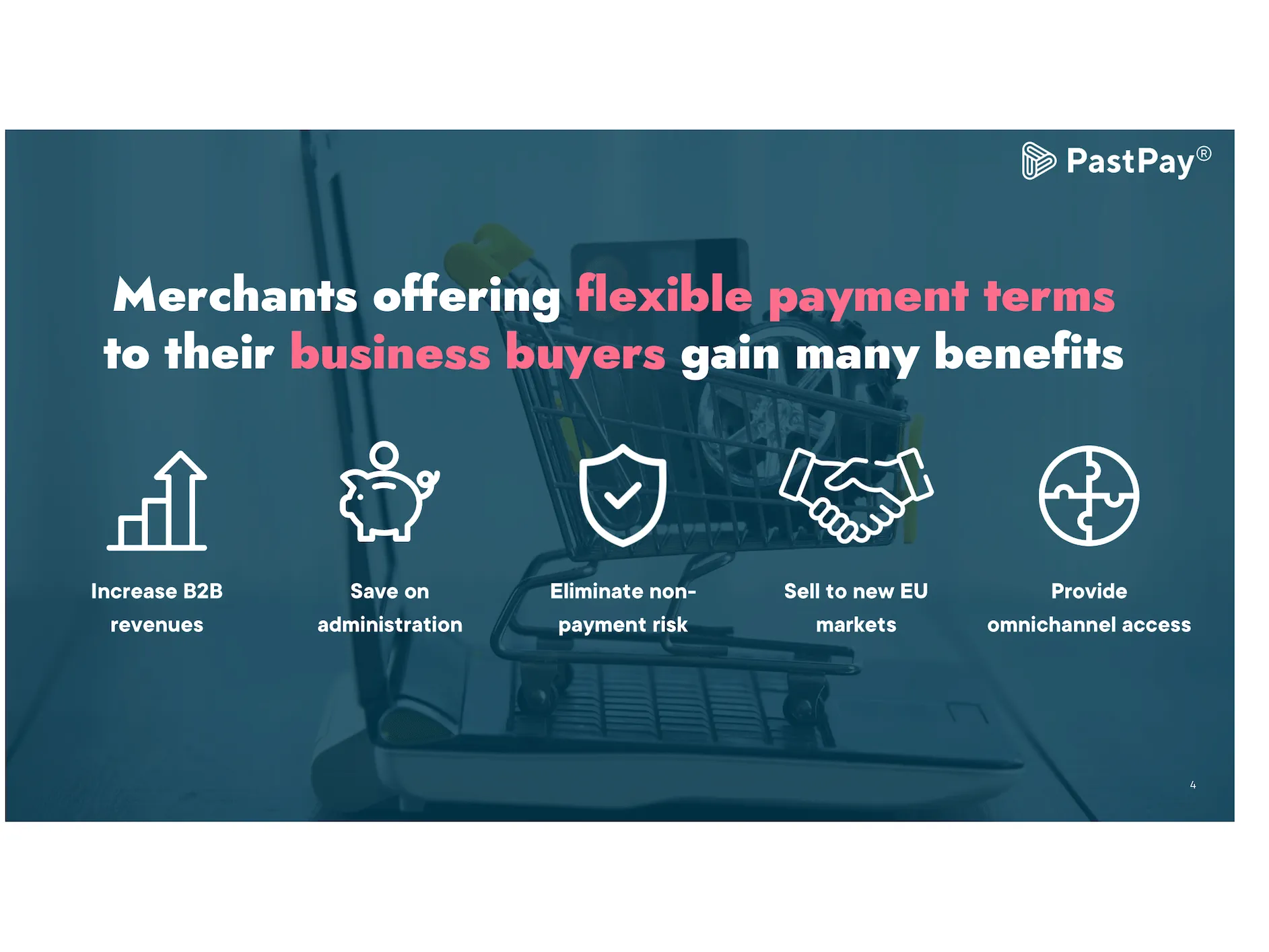

Flexible Payment Solutions

By offering flexible payment terms through factoring, PastPay helps improve liquidity and unlock cash flow for businesses. Typically, companies face cumbersome payment timelines ranging from 15 to 90 days. With PastPay, merchants are approved to receive cash against their invoices within 24 hours, minus applicable charges.

- Merchants obtain quick access to funds

- Addressing the B2B payment gap

- Expanding the BNPL market for SMEs

Conclusion: A Bright Future for Fintech Startups

The market for B2B BNPL is rapidly expanding, fueled by the ongoing push for digital payment solutions. As Benjamin Berényi, PastPay's CEO, states, the focus on fulfilling the needs of small and medium-sized enterprises is more crucial than ever in today's economy.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.