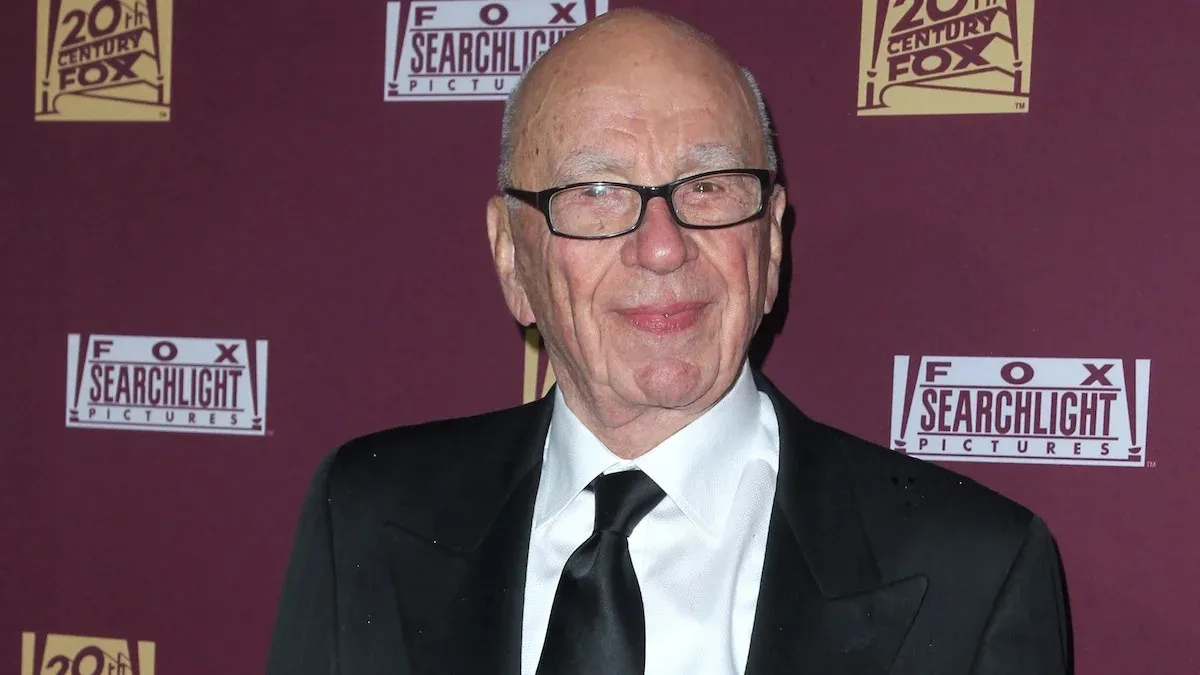

Activist Investor Starboard Value LP Proposes Changes to News Corp Under Rupert Murdoch's Leadership

Activist Investor Starboard Value LP Challenges Rupert Murdoch's News Corp Structure

In a bold move, activist investor Starboard Value LP has proposed fundamental changes to the governance of News Corp, led by Rupert Murdoch. The firm aims to eliminate the dual-class share structure that has historically given Murdoch's family predominant control, holding 41% of voting shares while holding only a 14% economic stake.

The Proposal's Implications

Starboard asserts that this shift is crucial for enhancing shareholder value in News Corp. The proposal seeks to increase accountability and attract more institutional investments by aligning voting rights with economic interests.

Investor Sentiment and Market Response

The reaction from investors has been varied, with some welcoming this initiative, believing it will catalyze change and lead to better performance. However, supporters of the Murdoch family's approach remain cautious, asserting that stability has been paramount for the media giant.

Potential Challenges Ahead

This move is expected to face opposition from existing board members who are aligned with Murdoch's vision. The potential backlash could lead to a contentious battle over corporate governance, making this an unfolding story worth following closely.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.