Nippon Steel Corp's Ambitions for United States Steel Corp and the Political Landscape

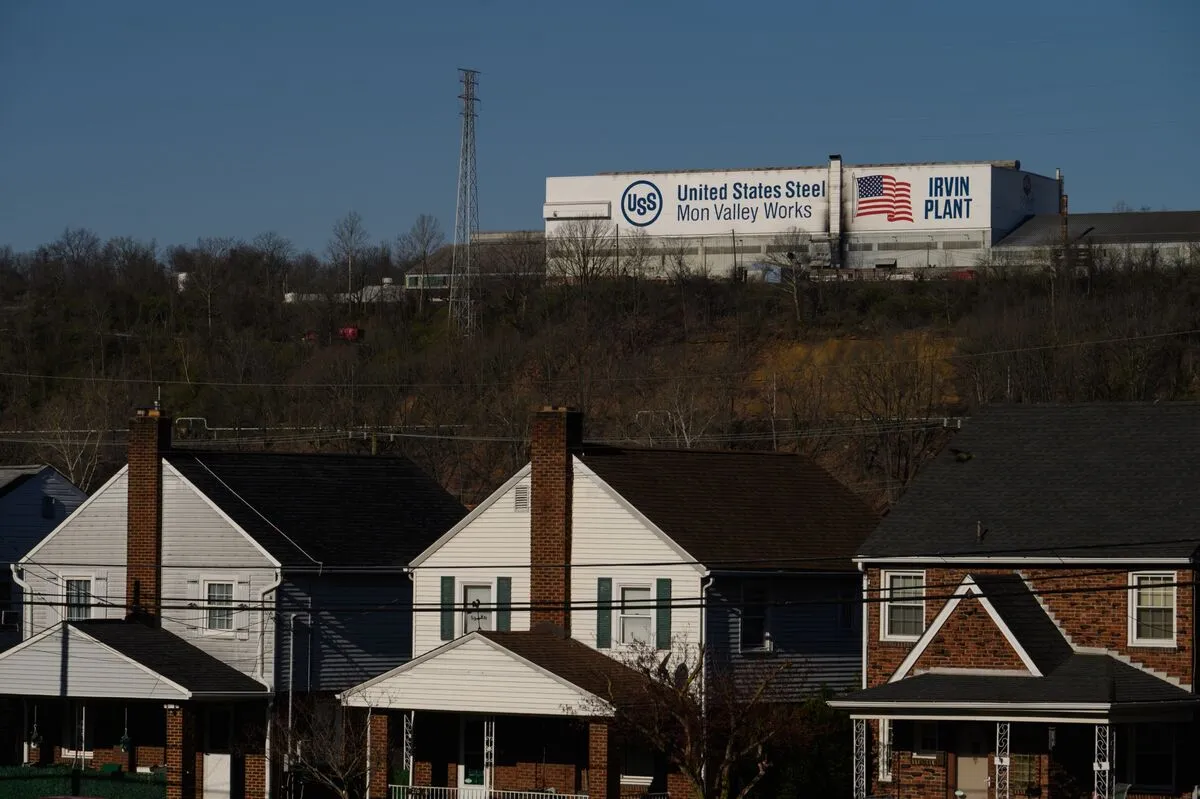

Nippon Steel Corp is eyeing a significant acquisition of United States Steel Corp, a move that could reshape the current landscape of the steel industry. As President Joe Biden and his administration deliberate on this acquisition, the fate of Nucor Corp and Steel Dynamics Inc hangs in the balance. Should Nippon Steel's $14.1 billion takeover falter, United States Steel Corp may face disassembly and sale in parts, raising concerns among investors and industry insiders alike.

Implications for the Steel Industry

The potential takeover by Nippon Steel Corp highlights the complex interplay of private equity and political considerations. Should the deal succeed, it would mark a pivotal movement in the global steel market, specifically in relation to US-Japan trade dynamics.

Political Maneuvering

With the White House closely involved, David Boyd Burritt, CEO of United States Steel Corp, is under pressure to align stakeholders amid potential political ramifications. The outcomes rest not just on corporate strategies but also on shifting political sentiments and regulatory frameworks.

Future Outlook

Ultimately, the success or failure of this deal will reverberate through the steel sector. Investors should closely monitor developments as the steel industry braces for potential volatility.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.