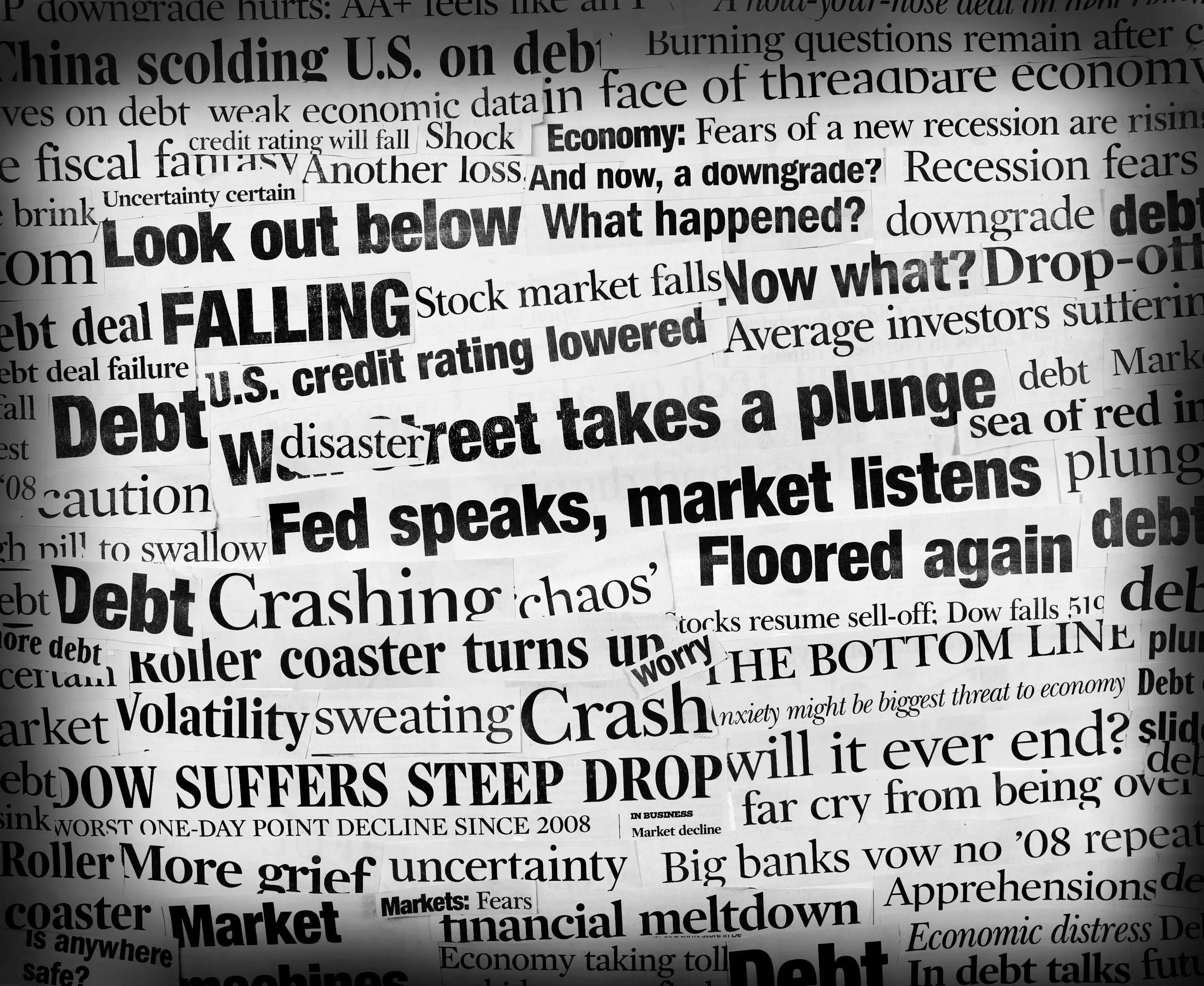

Equity Booms Do End: What to Expect in the Second Half of 2024

Understanding the End of Equity Booms

The recent performance of the Dow, reaching unmatched highs, raises concerns. iOther sectors are not coalescing to support this surge, leading some to speculate about a potential market peak. As equity booms do end, investors must brace for prospective downturns in the coming months.

Signs of a Market Top

- Bellwether Stocks Lagging: Major indicators like blue-chip stocks are showing signs of fatigue.

- Sector Disparities: The divergence in performance across different sectors signals instability.

What Lies Ahead

With economic indicators trending down, the second half of 2024 may bring significant challenges. iMarket participants should evaluate their portfolios and consider risk management strategies as volatility often accompanies market corrections.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.