NFP Reports: How Macroeconomics Influence United States Equities

NFP Reports and Their Impact on Equities

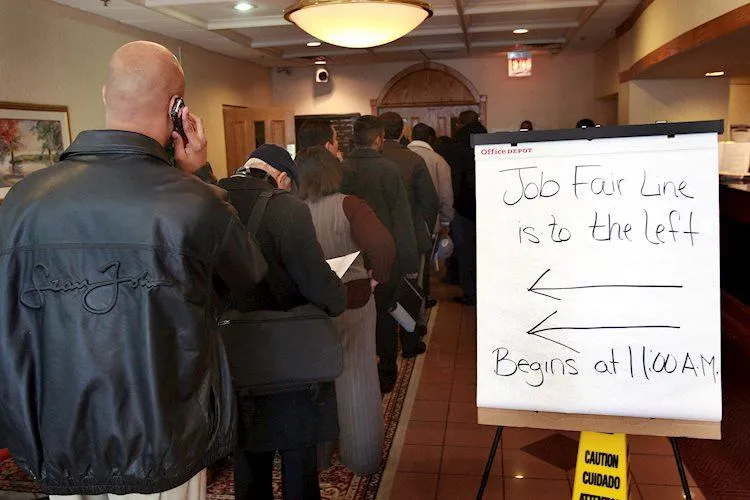

The recently released NFP report indicates that the United States added only 99,000 private sector jobs, falling short of the 145,000 expected. This lower-than-anticipated growth offers insight into current economic conditions. Investors need to assess how these numbers influence future equities performance.

Key Insights from the NFP Report

- Slower Job Growth: The decline in job creation suggests potential instability in the labor market.

- Impact on Macroeconomics: Lower employment numbers could lead to weaker consumer spending.

- Equity Market Response: Investors are likely to be cautious as they analyze these signals.

Broader Implications for Investors

Understanding how the NFP data affects equities can offer valuable insights into macroeconomic trends. With the economy showing signs of deceleration, investors should monitor these reports closely.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.