China's Brokerage Merger: A Strategic Move by Chinese Brokerages to Conquer Wall Street

China's Brokerage Merger: A New Era for Chinese Brokerages

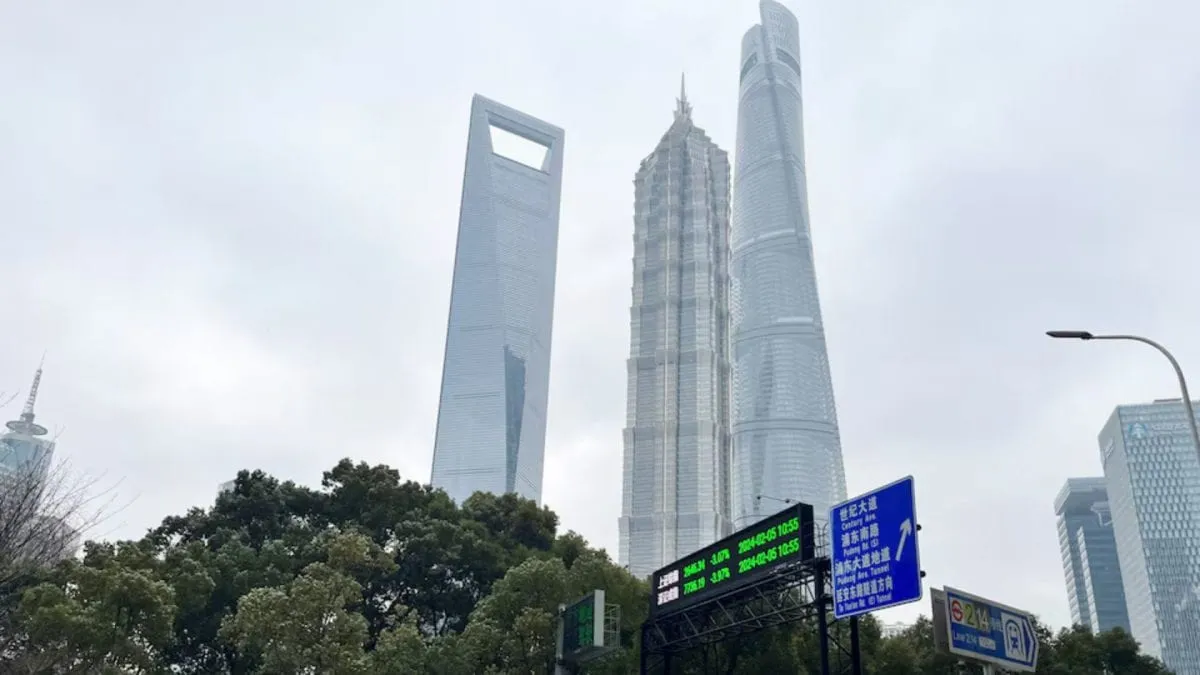

The merger of Guotai Junan Securities and Haitong Securities is set to reshape the China stock market, creating a $230 billion brokerage powerhouse aimed at challenging Wall Street.

Details of the Merger

Shanghai-based Guotai Junan Securities plans to acquire Haitong Securities through a share swap, aiming to consolidate the Chinese stocks sector and establish dominance in the market. The proposed deal, subject to regulatory and shareholder approval, is a response to the need for industry reform.

Potential Impact on the Market

- The combined entity will possess over 1.6 trillion yuan ($226 billion) in total assets.

- Expected to surpass Citic Securities as China's largest brokerage.

- Shares of both brokerages experienced significant jumps following the announcement.

Regulatory Support and Future Outlook

The China securities regulator has emphasized the need for mergers and acquisitions within the brokerage industry, aiming to streamline and enhance competitiveness among firms.

- 10 leading institutions are targeted for development over the next five years.

- Plans include transforming firms into internationally competitive investment banks by 2035.

Analysts' Perspectives

Experts suggest that this merger signals an upcoming wave of consolidation in the Chinese brokerages landscape. The current market dynamics highlight both challenges and opportunities for growth in the financial sector.

Market Reactions

Following the merger news, shares in Chinese brokerages soared by substantial percentages, indicating revived investor interest and optimism in the sector.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.