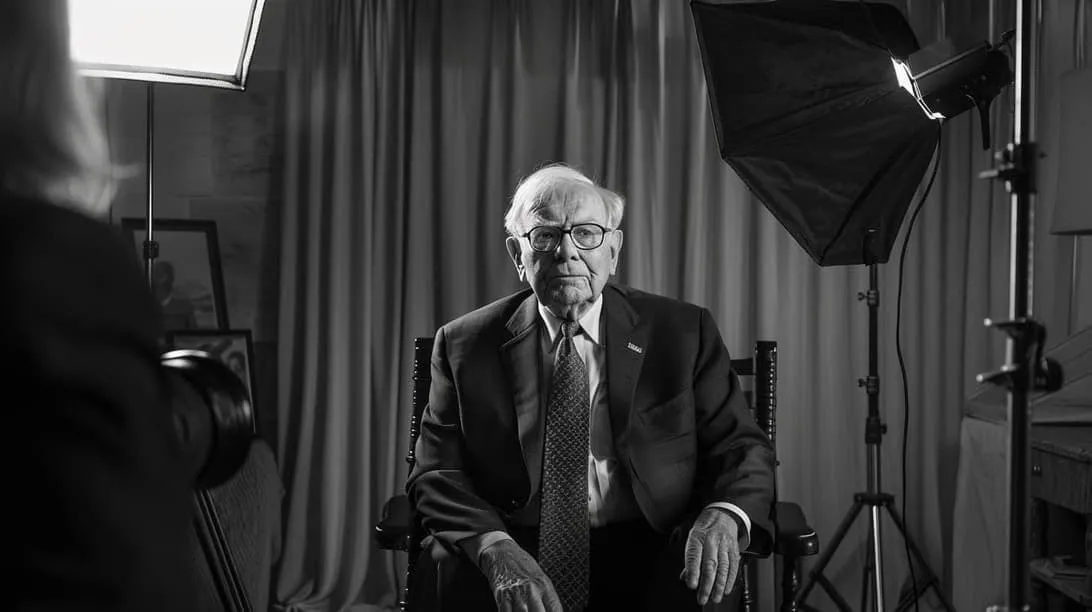

Bank of America Under Scrutiny After Warren Buffett's $760 Million Stock Sale

Warren Buffett's Recent Bank of America Transaction

Despite holding onto his Bank of America (NYSE: BAC) shares during the second quarter, Warren Buffett, the CEO of Berkshire Hathaway (NYSE: BRK.A), has made a startling decision to sell $760 million worth of BAC stock. On September 5, Buffett sold 18,746,304 shares at an average price of $40.51, culminating in a total profit of $759.5 million. This marks a significant part of his ongoing strategy of divesting stocks, a trend that began post-Q2.

Buffett's Holdings and BAC's Performance

- Current BAC holdings have diminished from over 1 billion shares to approximately 863 million.

- The stock represents 11% of Buffett’s portfolio, valued at around $34.7 billion.

- Since July 2, BAC stocks experienced volatility, peaking at $44 but showing resilience with only a slight overall decline to $40.14 by September 5.

Future Insights on Bank of America Stock

This strategic selling raises questions about the future trajectory of Bank of America shares. As Berkshire Hathaway's cash reserves swell, moving from $160 billion to nearly $300 billion in 2024, investors speculate if Buffett will reinvest this capital strategically or continue his selling trend.

Investors should remain vigilant about changes in Buffett's investment patterns as they may indicate shifting market dynamics.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.