Ether ETF Impact on Markets: A 20% Decline in ETH Liquidity

The Dwindling Liquidity Following Ether ETF Launch

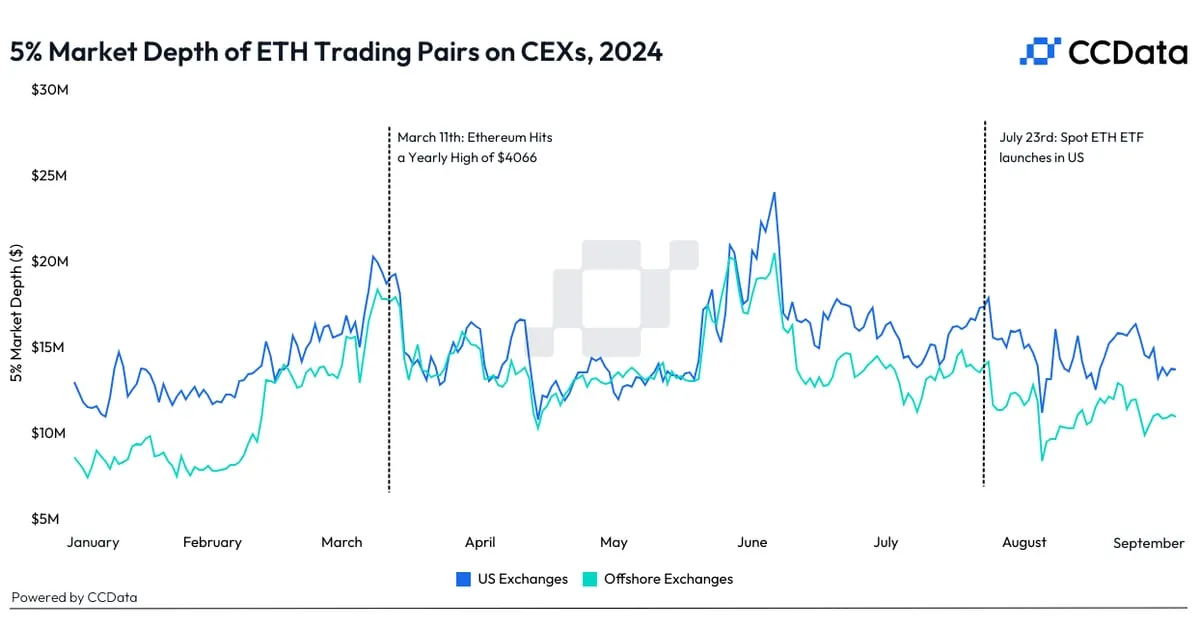

In the wake of the ether ETF introduction, market dynamics have shifted considerably. ETH liquidity has witnessed a sharp decline, diminishing by 20%. This decline raises critical concerns regarding market absorption capabilities during significant trading sessions.

Understanding Liquidity in the Ether Markets

Order book liquidity measures the market's ability to handle substantial buy and sell orders without significantly impacting the spot price. Liquidity is paramount for maintaining stability in any financial market, particularly in cryptocurrency trading.

- Market Absorption and Pricing

- Effects on Traders and Investors

- Potential Long-term Consequences

What Lies Ahead for Ether?

The substantial drop in liquidity raises essential questions about the future of ether. Analysts speculate on potential trends and shifts in trading behavior that could unfold as the market adjusts to this new reality.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.