U.S. Dollar Decline Signals Potential for Further Downside Risks

The U.S. dollar has held its ground this week after a sharp decline in August that sent the dollar index to its worst month since November—but strategists at BofA Global Research believe its recent weakness will lead to further downside for the greenback over the next few months.

The ICE U.S. Dollar Index, which tracks the buck’s strength against a basket of six other currencies, slumped 2.3% in August. That was its biggest monthly decline since November 2023, according to FactSet data. The DXY was off nearly 0.3% to trade around 101.10 on Thursday early afternoon, having largely treaded water so far this week.

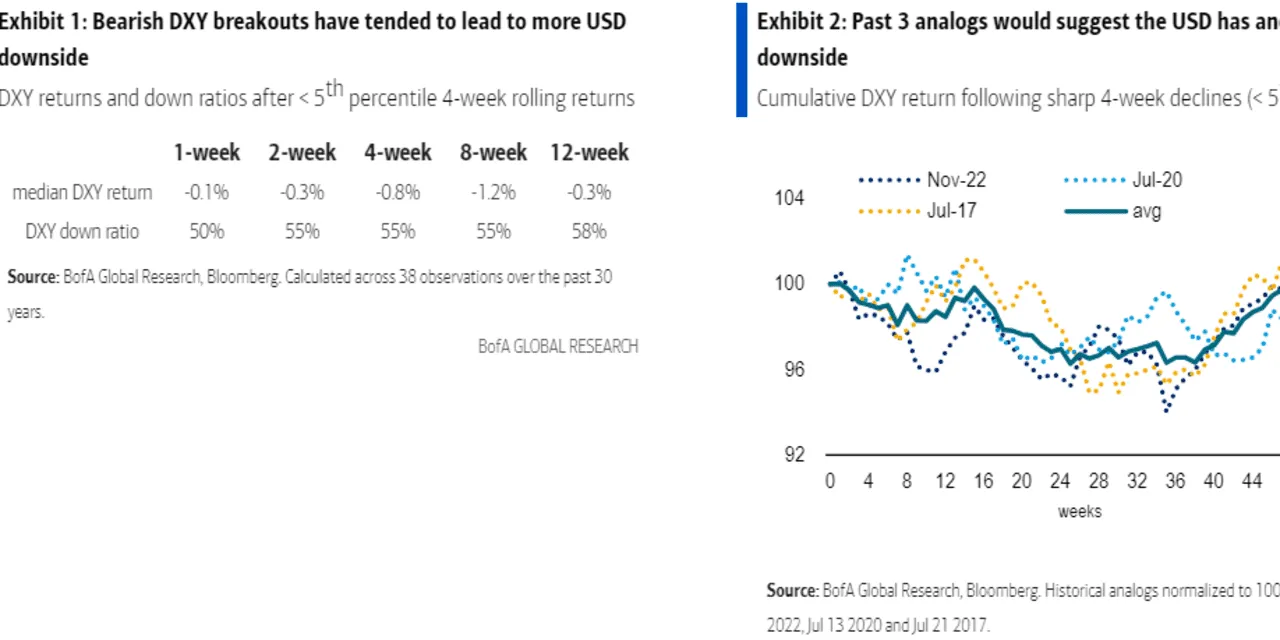

“The USD selloff was in focus for FX investors last month, and the weakness stood out in a historical context,” said a team of BofA Global strategists led by Howard Du. “Despite the outsized USD weakness and recent retracement on the back of month-end USD demand, we believe the USD has entered a ‘sell-the-rally’ regime and see more room for further USD downside.”

In a note published Thursday, Du and his team laid out three reasons to remain bearish on the buck despite its weakness in August.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.