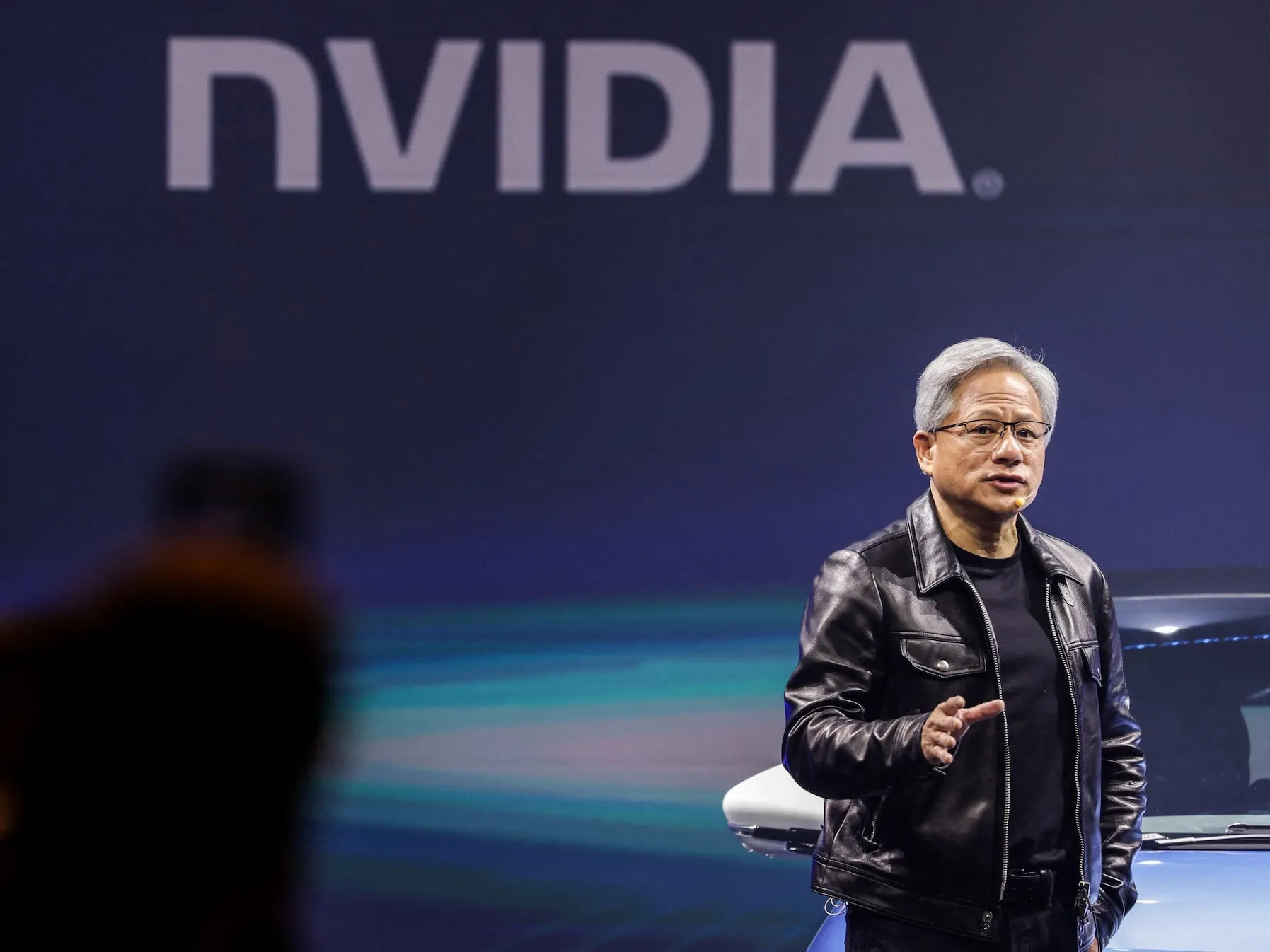

Nvidia Stock Leads Markets in AI Rally Downturn: Exclusive Insights

Nvidia Stock Takes a Hit

Nvidia's stock has recently witnessed a serious 15% plunge, resulting in an astonishing market value loss of $279 billion in just one day. This unprecedented decline marks the largest one-day drop in U.S. corporate history, leaving investors surprised.

Headwinds Against Nvidia

Following a disappointing earnings report, which failed to meet bullish expectations, concerns arose that the AI rally might be losing momentum. Additionally, news of a subpoena from the Department of Justice stirred uncertainty among Nvidia enthusiasts.

Bank of America's Perspective

Despite these challenges, Bank of America views this decline as an attractive buying opportunity. They note that Nvidia's shares are currently trading at some of the lowest valuations seen in the past five years, indicating potential investing opportunities for the future.

What This Means for Investors

- Consider Market Trends: Keeping an eye on market movements can aid in strategic investment decisions.

- Evaluate AI Sector Potential: The prospects of artificial intelligence technology continue to drive interest.

- Watch for Recovery Signs: Investors should look for signals of recovery in *Nvidia stock* as a gauge for the AI market.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.