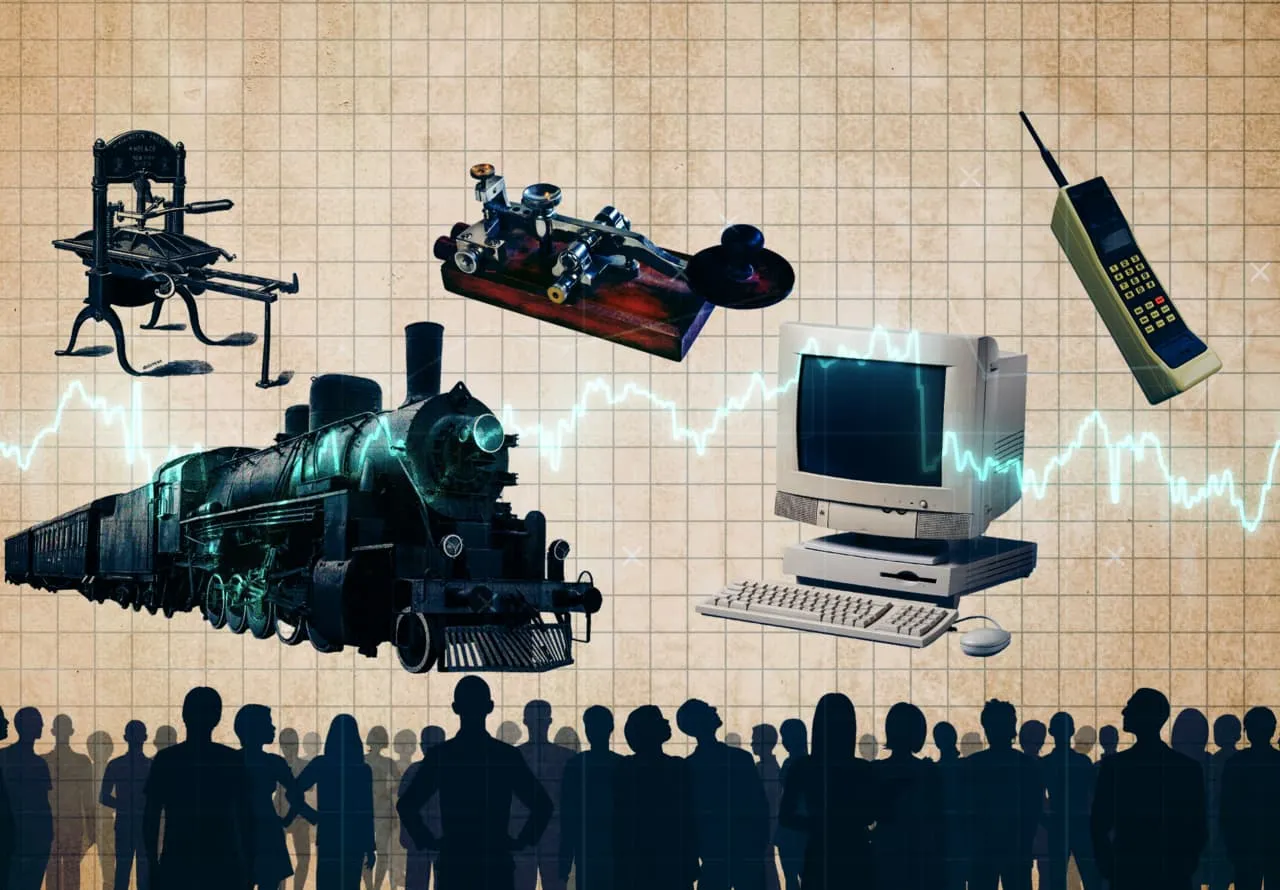

AI Investors Must Study Canal and Railway Bubbles for Future Success

AI Investors Must Study Historical Market Bubbles

AI investors should take heed of lessons from the canal and railway bubbles, emphasizing the cyclical nature of investment fads. These bubbles often overstated the value of emerging technologies, leading to substantial financial repercussions.

Key Takeaways from Historical Bubbles

- Understanding the cycle of bubbles can prevent costly mistakes.

- Investment in innovation is essential, but restraint is necessary.

- Historical patterns can provide valuable insights for current AI investments.

Conclusion: Learning from the Past

Acknowledging these lessons, AI investors must approach modern opportunities with both ambition and caution. The intersection of innovation and speculation remains complex.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.