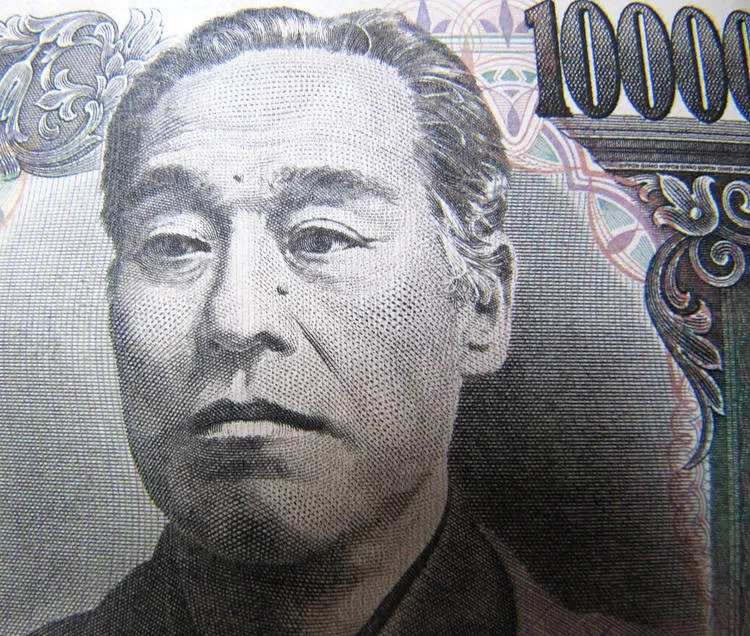

USD/JPY Performance and Implications Amid Bank Strategies

USD/JPY Trading Overview

USD/JPY is currently showcasing a sideways trend near recent lows. The continuous decline in the USD, coupled with changes in UST yields, has captured market attention. According to OCBC FX strategists, the interplay of Japanese banking actions and global economic conditions plays a pivotal role.

Factors Impacting USD/JPY

- BOJ Policies: The Bank of Japan's monetary policy significantly influences USD/JPY valuations.

- USD Weakness: A broader decline in the USD has resulted in pressure on this currency pair.

- Global Banking Strategies: Strategies employed by global banks also contribute to market dynamics affecting USD/JPY.

Market Implications

As USD/JPY navigates this sideways phase, traders are advised to maintain vigilance on economic indicators and BOJ reactions. Further fluctuations in UST yields may precipitate shifts in currency responses.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.