Retail Investors Buy the Dip During U.S. Stock Market Selloff

Thursday, 5 September 2024, 06:07

Market Overview

The major U.S. stock market indexes sank the day after Labor Day, leading to a notable decline in investor sentiment.

Performance Insights

- Dow Jones Industrial Average: Dropped 1.5%

- S&P 500: Declined 2.1%

- Nasdaq Composite: Fell 3.3%

Retail Investor Reactions

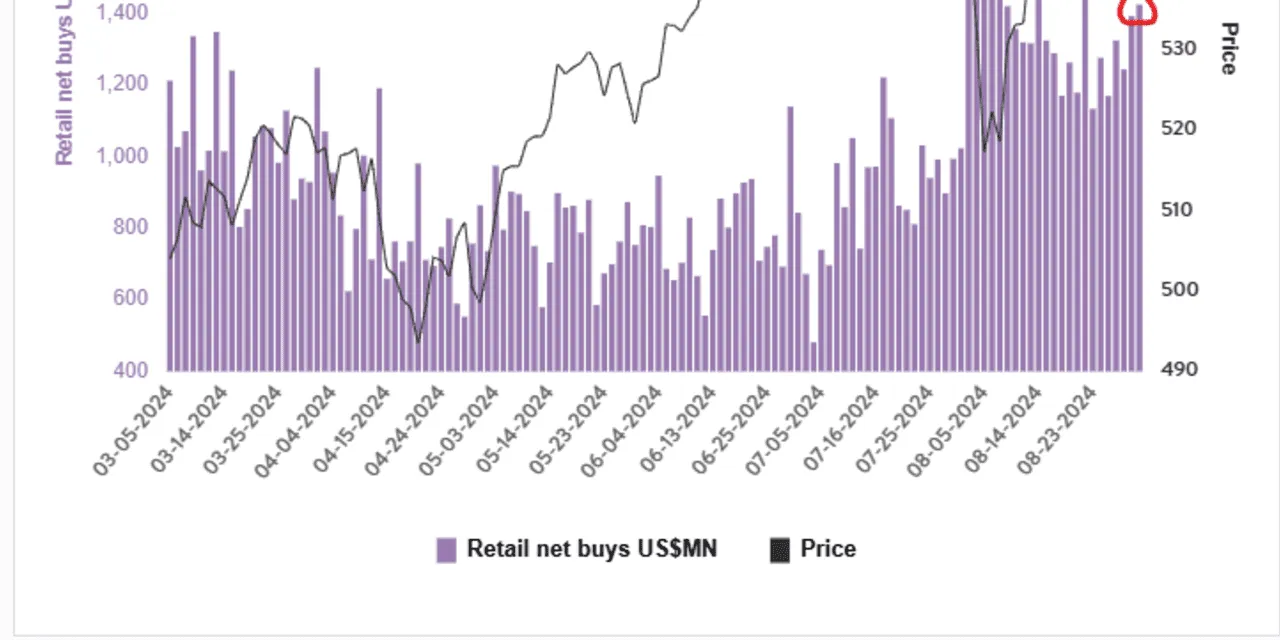

During the selloff, retail investors displayed a tendency to buy the dip, although the momentum was less vigorous than observed in prior months.

- Marco Iachini from Vanda Research noted a mild increase in buying activity.

- However, he stated, “Retail tends to not really chase the first dip as hard.”

- This suggests a more cautious approach among retail investors this time around.

For a comprehensive analysis, consider visiting the source for more details.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.