Ether Trading Volume Decline: CME Futures and ETH ETF Performance Insights

Thursday, 5 September 2024, 09:27

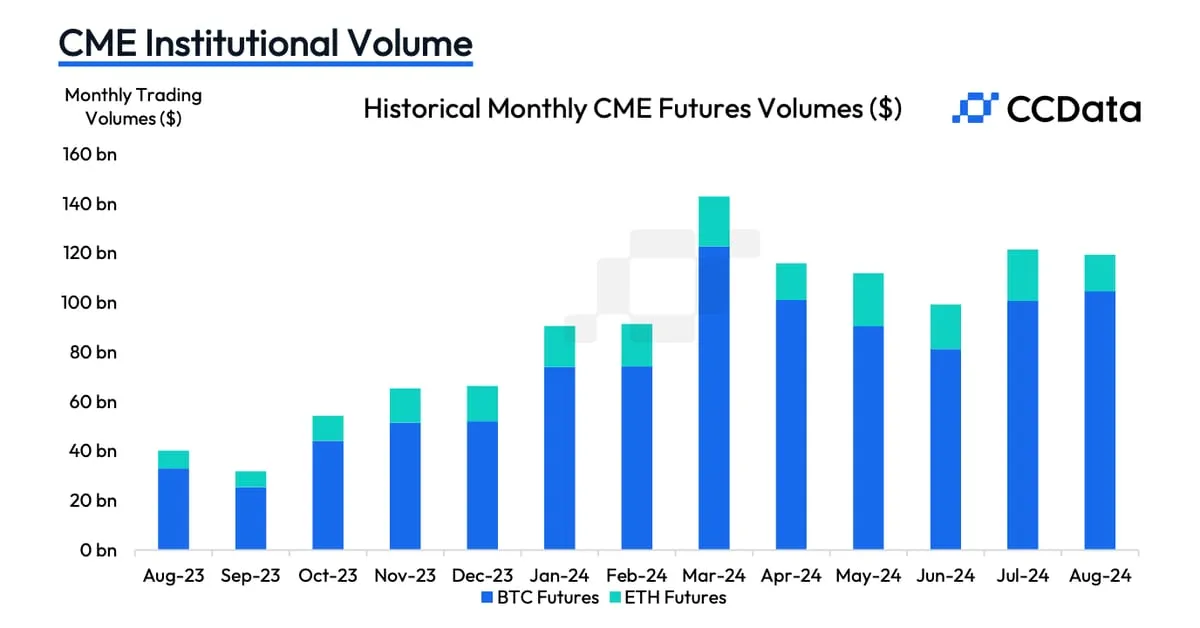

Understanding Ether Trading Volume Trends

The decline in ether trading volumes, particularly in CME futures, raises critical concerns about institutional interest. Recent launches of ETH ETFs have not brought the anticipated engagement, indicating a potential shift in market dynamics.

Impact of CME Futures on Ether

- The CME's ETH futures market has experienced decreased trading volumes.

- Investors show reluctance to engage with ether due to disappointing ETF performance.

- Market analysts are closely monitoring these trends for future implications.

Key Takeaways from Current Market Performance

- CME futures trading volume is a critical indicator of institutional sentiment.

- Weak performance of ETH ETFs may hinder future investments.

- Overall trading activity in the crypto market signals a period of caution.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.