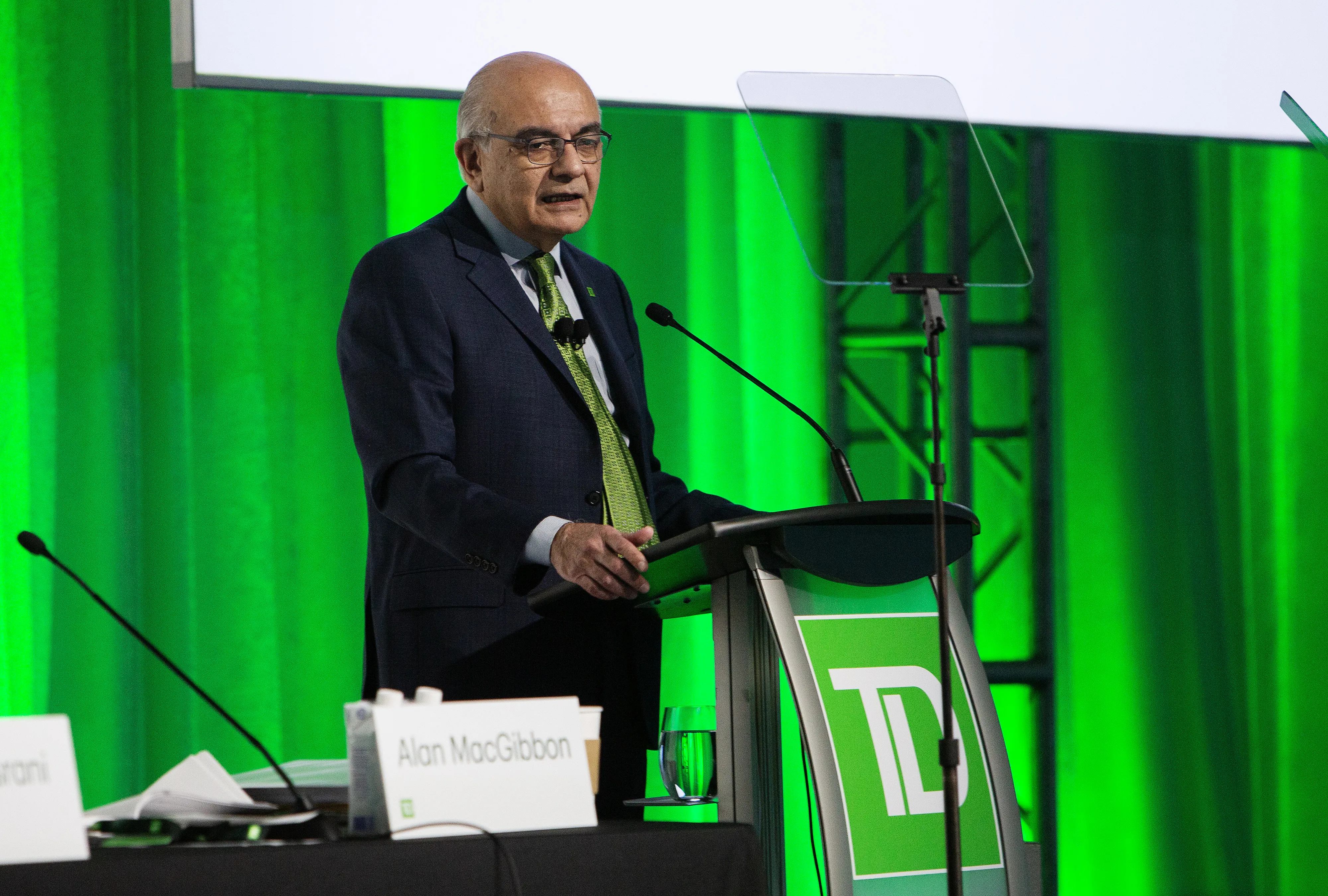

Risk Management Failures at TD Bank: Insights from the CEO

Understanding Risk Management Failures

Risk management at TD Bank has come into sharp focus as the CEO acknowledges that the bank's size contributes to oversight failures. Regulatory compliance remains a top concern, particularly in light of significant financial repercussions.

Regulation and Compliance Penalties

The bank projects more than $3 billion in penalties due to regulatory issues, primarily related to anti-money-laundering efforts. This situation raises critical questions about operational practices in large financial institutions.

- Scale of Operations: Larger institutions may face unique challenges in compliance.

- Financial Impact: Regulatory penalties can severely affect profitability and investor trust.

- Potential for Improved Practices

Long-term Strategies

To address these challenges, the bank must evaluate its risk management strategies and enhance its regulatory compliance efforts. Implementing stronger oversight mechanisms could play a crucial role in preventing future failures.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.