BuyToLet Landlords Warned About Rising Rent Arrears Amidst Dailymail Money Reports

Understanding the Rent Arrears Risk for BuyToLet Landlords

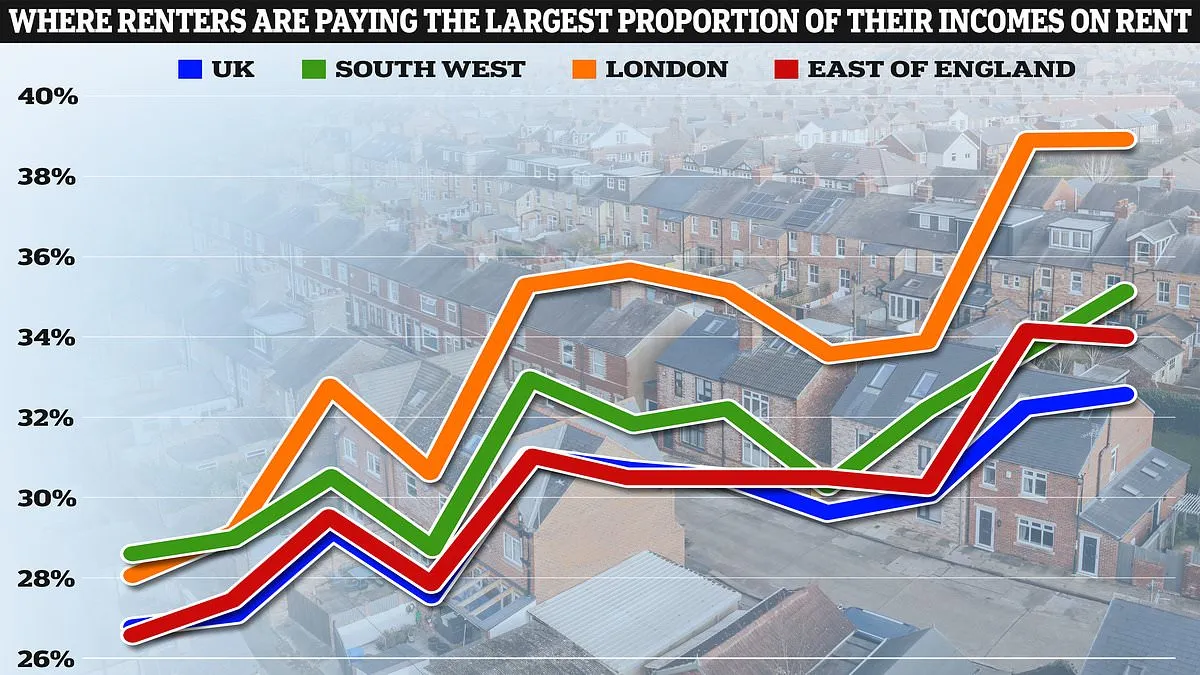

Dailymail money articles highlight a troubling trend: buyers and landlords in the BuyToLet sector may be overwhelmed by rising rent arrears. Currently, the average renter spends 32.6% of their income on rent, compared to 26.8% a decade ago. This drastic increase signifies a potential financial storm for landlords.

Why Renters Are Struggling

The financial landscape has evolved, pushing everyday renters into a corner. Here are some key points:

- Increased Cost of Living: With inflation and other economic pressures, renters are feeling the squeeze.

- Stagnant Wages: Many workers face stagnant salaries that struggle to keep up with rising rental prices.

- Economic Uncertainty: Job security is wavering, making it difficult for individuals to commit to rent payments.

Opportunities for Landlords

Despite these challenges, there are strategies that landlords can employ to reduce their risks:

- Increase Flexibility: Consider offering payment plans to tenants who may struggle with traditional monthly obligations.

- Engage with Renters: Developing a relationship can ease tensions and encourage timely payments.

- Market Responsively: Keep an eye on local rental trends to adjust prices accordingly.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.