Antitrust and Artificial Intelligence: Nvidia's Influence on Big Tech Stocks

Antitrust Investigation Triggers Global Market Reaction

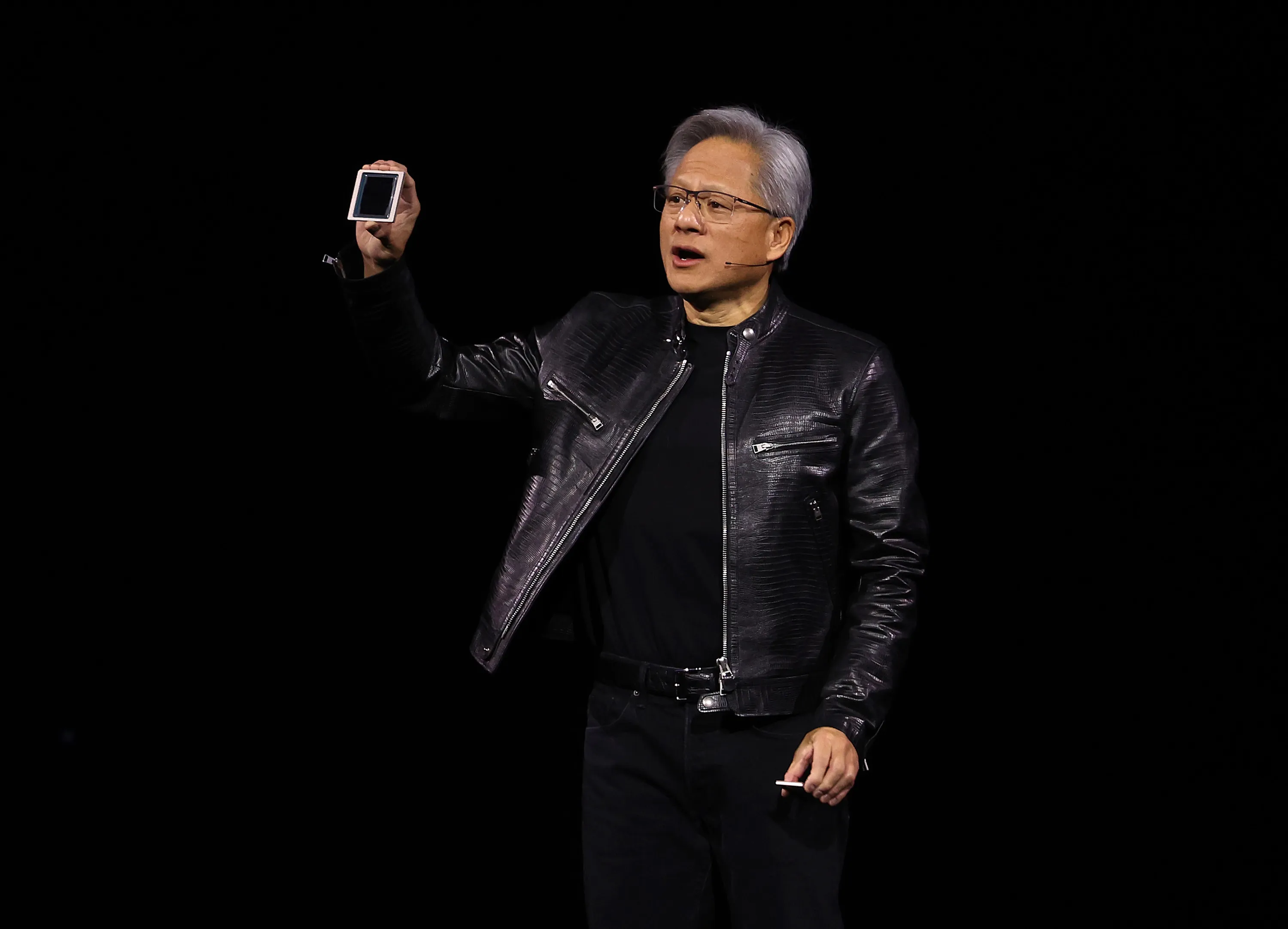

Nvidia, the leading player in the AI chip market, triggered significant sell-offs across global markets due to antitrust probes. On Tuesday, the US Justice Department's subpoena led to a massive $279 billion loss in share value, marking a staggering 9.5% drop. This event has not only heightened anxiety over Nvidia's market prowess but also raised alarms about the sustainability of investments in emerging tech, particularly in a market dominated by big tech giants.

Nvidia's Widespread Influence

As the third most valuable company worldwide, Nvidia's trajectory significantly impacts leading tech stocks like Microsoft and Meta, which heavily rely on Nvidia's technology. Reports indicate that these companies invest around 40% of their hardware budgets on Nvidia products, intensifying fears that a downturn in Nvidia could reflect broader issues within the tech sector. Fears about high valuations and the actual utility of AI technology have caused widespread concern, with analysts from major firms like JPMorgan and Blackrock warning of potential overvaluation.

Global Economic Considerations

Recent sentiments about China's slowing economy and weakening manufacturing sectors in the US further compound these worries. As investors remain jittery, the outlook for the AI sector and the economy grows more uncertain, prompting speculation about whether the commitment to AI by large companies will yield substantial returns. Daniel Newman, CEO of Futurum Group, remarked that Wall Street is seeking clarity on how these companies plan to generate value amid rising skepticism.

Conclusion: A Signal of Economic Health?

The sell-off is alarming, yet it's worth noting that stock market performance is not an infallible indicator of economic health. With a potential interest rate cut from the Federal Reserve on the horizon, it remains to be seen how these pressures will shape the market moving forward. Nvidia's recent struggles may reflect deeper market dependencies rather than a straightforward forecast of recession.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.