Mergers and Acquisitions Impacting Trump Media and Technology Group in 2024

Wednesday, 4 September 2024, 07:22

Mergers and Acquisitions Shaping Trump's Media Future

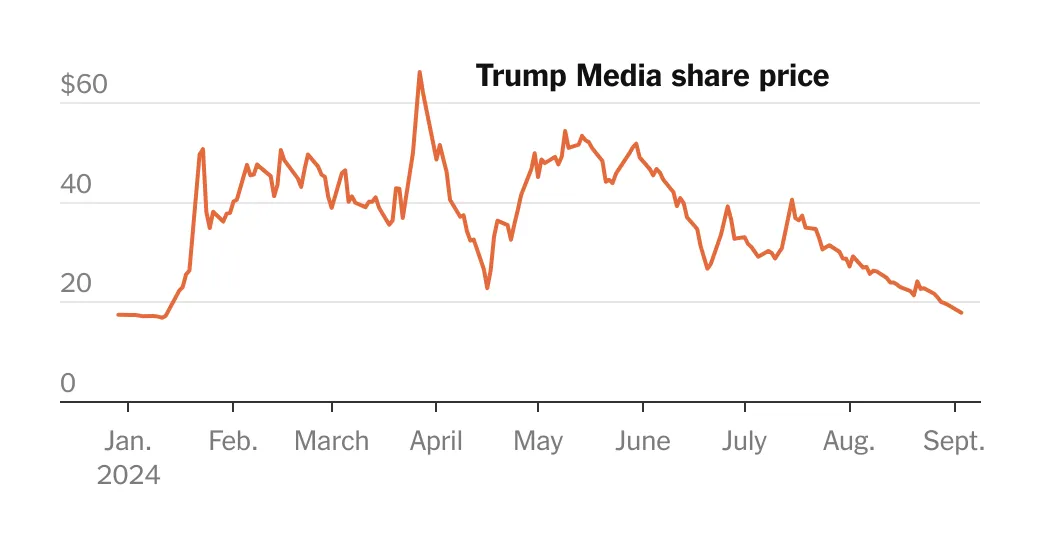

In the ever-shifting financial landscape, mergers and acquisitions are central to understanding the dynamics surrounding Trump Media and Technology Group. With stocks and bonds responding to investor sentiment influenced by the upcoming presidential election of 2024, the Trump Media shares have plunged significantly.

Impact of Social Media on Share Prices

- Trump Media's stock price has faced a staggering decline of 70% since its March peak.

- The fate of the company is closely tied to perceptions of Donald Trump's standing in the electoral race.

- Truth Social, its flagship platform, mirrors these market fluctuations, showcasing a direct link to Trump's media influence.

Analysis of Current Market Trends

- The tumultuous relationship between stocks and bonds and the political landscape remains critical.

- Digital world acquisitions are reshaping traditional market dynamics.

- Investor strategies must evolve alongside the presidential election of 2024.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.