LexinFintech Faces Loan Origination Miss and Business Mix Changes in Q2 2024

LexinFintech's Loan Origination Performance

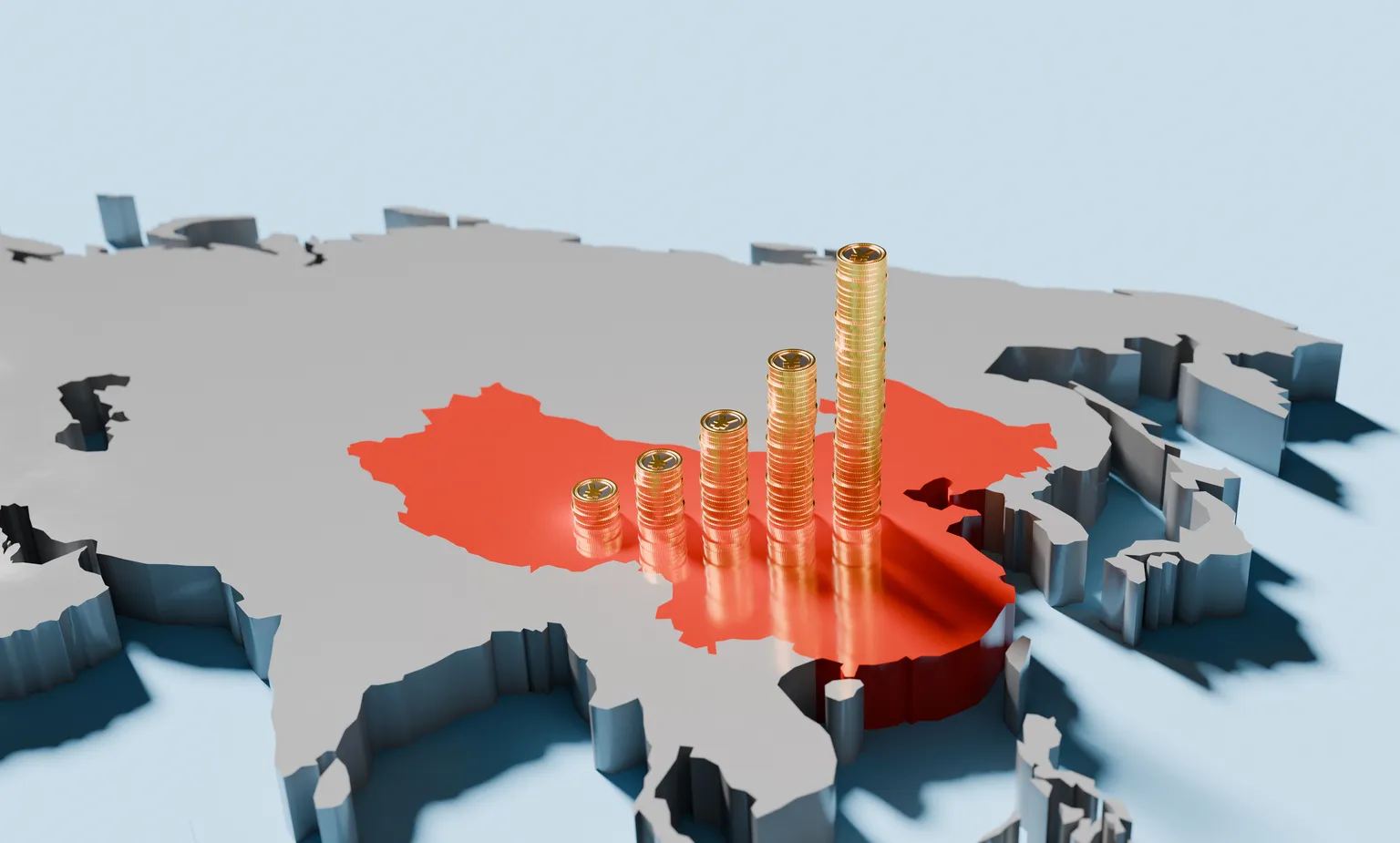

In Q2 2024, LexinFintech reported a significant 5%-7% miss in loan origination compared to earlier forecasts issued by management. This discrepancy is attributed to shifts in consumer demand and increased competition within the fintech sector. Investors should be aware of how these factors impact the business overall.

Business Mix Changes Impacting Revenue

The alterations in LexinFintech's business mix suggest a strategic pivot which may influence future mortgage and loan products. Understanding these developments is vital for stakeholders looking to assess potential stock performance. This shift could lead to unexpected volatility in LX stock value.

Implications for Investors

- Risk Assessment: Investors should conduct a thorough risk analysis of LexinFintech in light of these recent performance metrics.

- Market Positioning: Evaluate how LexinFintech's positioning in the market may affect its upcoming earnings reports.

- Long-Term Outlook: Consider the long-term growth trajectory of LexinFintech amidst changing market dynamics.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.