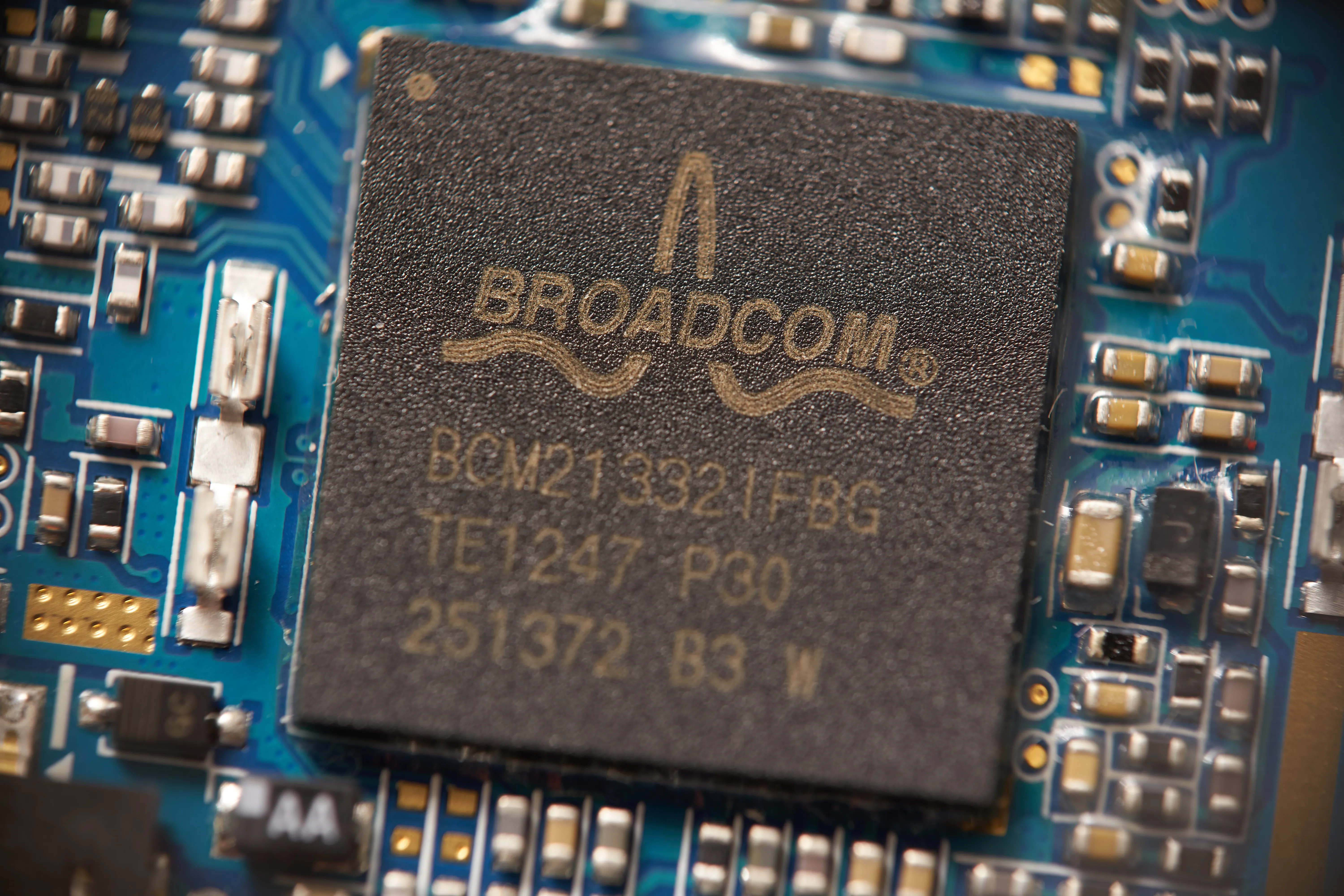

Broadcom Set to Beat Earnings Amid Strong AI Revenue Growth

Broadcom's Impressive Q2 Performance

Broadcom's Q2 FY2024 results have showcased a remarkable increase in sales, primarily fueled by AI revenue growth. The company's strategic investments and innovation in AI technologies have positioned it as a market leader, creating a buzz around its upcoming earnings report.

Q3 Outlook: Positive Margin Expansion

The prospects for Broadcom's Q3 look promising, with expectations of further margin expansion. Analysts predict that as AI becomes more integrated into various sectors, Broadcom stands to gain significantly. Investors are advised to keep a close eye on these developments.

Conclusion: A Buy for Investors

Given the solid fundamentals and a favorable outlook, AVGO stock remains a buy. The combination of strong earnings potential and strategic positioning in the AI market makes Broadcom an attractive investment opportunity.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.