Boeing's Bondholders Defensive Amid 7% Stock Drop Following Wells Fargo Downgrade

Boeing's Financial Outlook

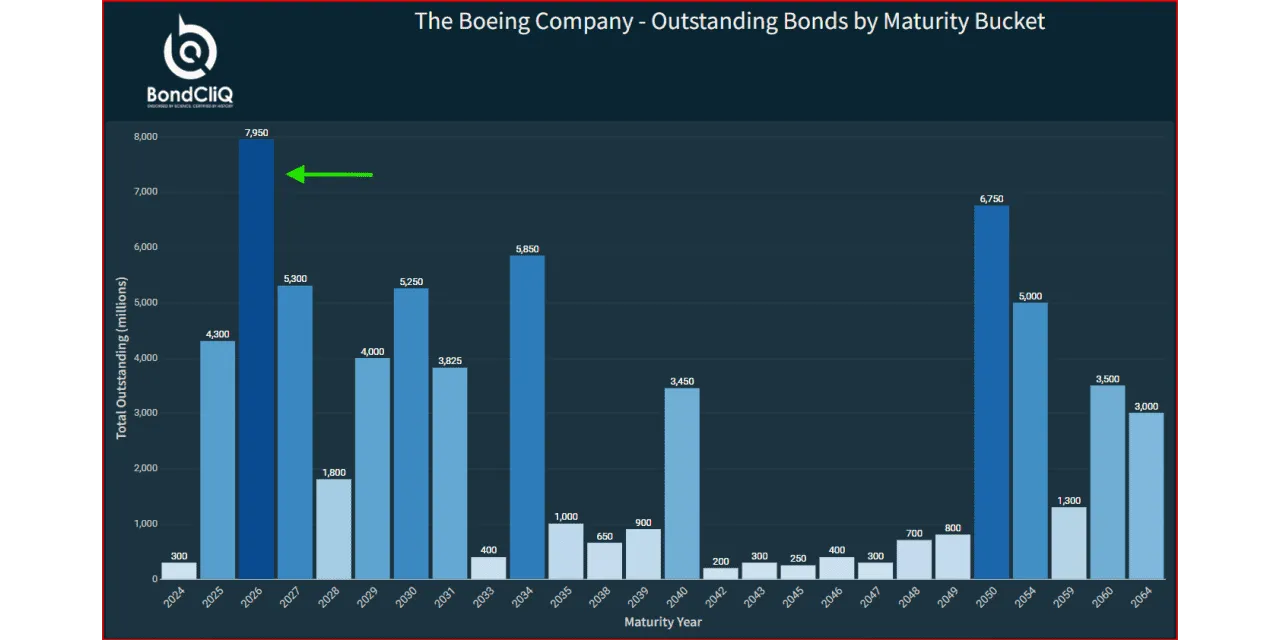

Boeing's bondholders face a precarious situation, as the company's stock plummeted 7% on Tuesday after Wells Fargo issued a warning to investors. Analyst Matthew Akers downgraded Boeing's stock rating to underweight, having maintained a hold rating since January. The reduced target price now stands at $119, sharply down from $185, marking him as the most pessimistic among the analysts covering Boeing.

Investor Sentiment

This alarming shift in perspective from Wells Fargo suggests that any future decisions by the troubled aerospace giant regarding their cash and debt strategies could have negative implications for its stock performance. The revised price target implies a sobering 25% downside from current price levels. Investors are now left to grapple with the uncertainties surrounding Boeing's financial maneuvers.

Conclusion

With bondholders remaining defensive and market analysts expressing heightened concern, the outlook for Boeing remains uncertain at best. Stakeholders must stay vigilant as the situation develops, weighing the potential risks alongside any forthcoming corporate strategies.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.