Boeing's Stock Falls 7% Following Downgrade by Wells Fargo

Tuesday, 3 September 2024, 13:07

Impact of Wells Fargo's Downgrade on Boeing's Financial Position

The latest downgrade from Wells Fargo has significantly affected Boeing's stock performance. After experiencing a decline of 7%, the concerns from bondholders highlight the gravity of the situation.

Key Takeaways from Analyst Matthew Akers

- Analyst Matthew Akers cut his rating on Boeing to underweight.

- The stock-price target was slashed from $185 to $119.

- This adjustment marks Akers as the most bearish among analysts reviewing Boeing, indicating substantial risk.

Potential Future Risks and Implications

- The new target implies a possible 25% downside for Boeing's stock.

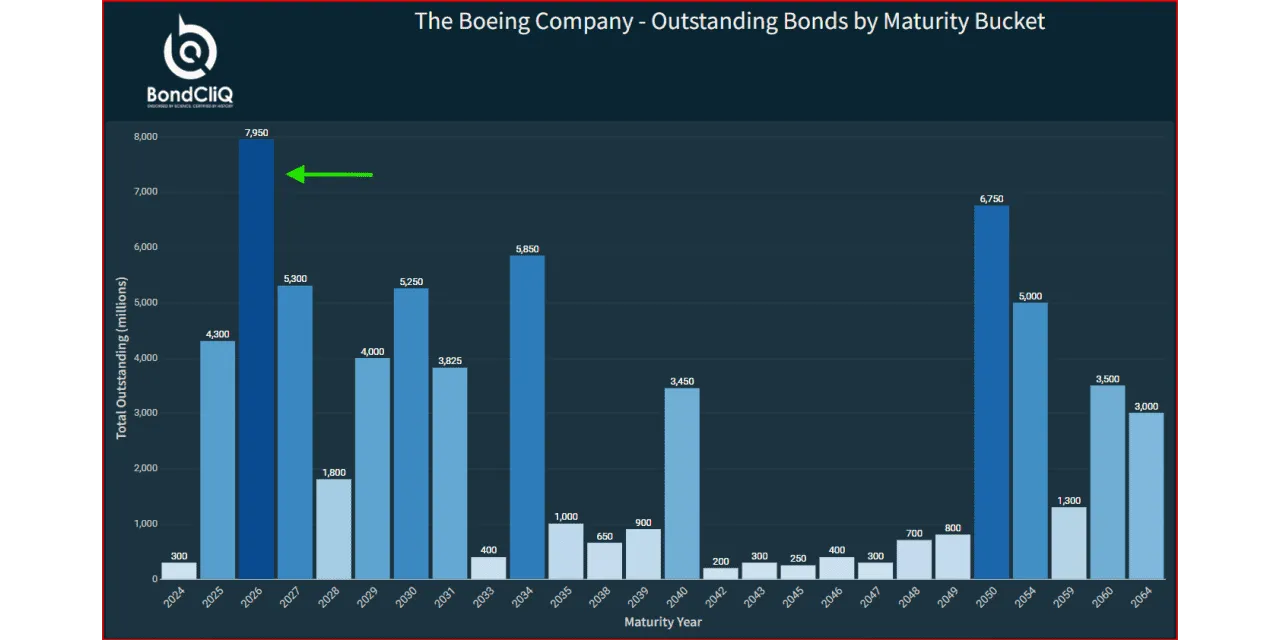

- Investors must stay alert regarding Boeing's decisions on cash and debt management.

- Bondholders may need to reassess their positions in light of the current market sentiment.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.