Exploring Fanuc's Volatility and the ETF Alternative

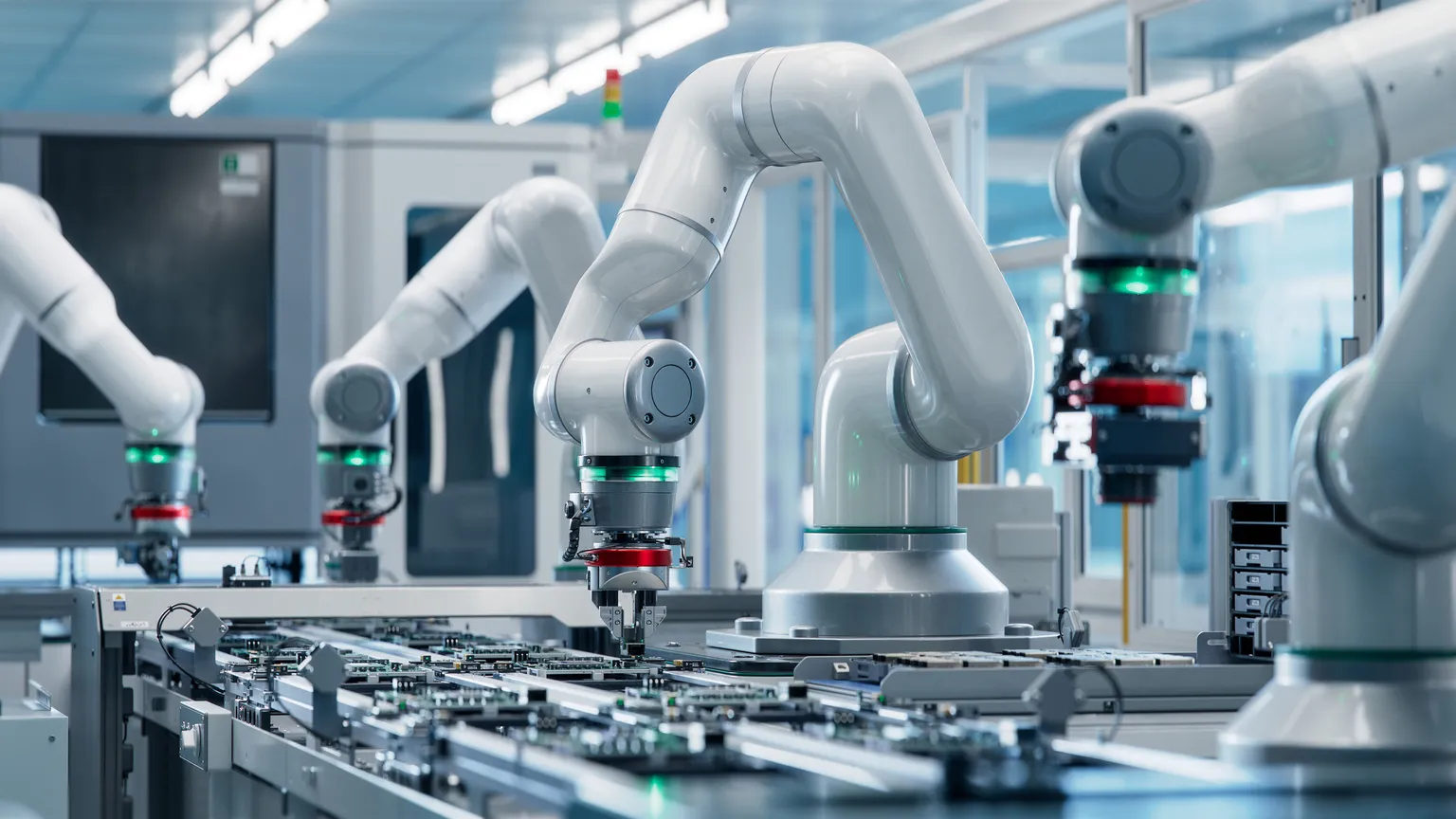

Understanding Fanuc's Market Position

As one of the leaders in the manufacturing automation sector, Fanuc has a strong market position. However, recent analyses of its financial performance raise questions.

Revenue Growth vs. Margin Improvement

Despite witnessing revenue growth, the company has struggled to enhance its margins. This trend has made many investors wary.

- Strong market presence

- Cash reserves

- Margin concerns

ETFs as an Alternative Investment

Considering the volatility of Fanuc, investors might find ETFs a safer investment vehicle. ETFs can offer diversification and reduced risk compared to investing in single stocks.

- Broader exposure

- Reduced volatility

- Stable returns

Final Thoughts on Investment Strategies

Ultimately, while Fanuc presents some opportunities, its unpredictability can lead to significant risks.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.