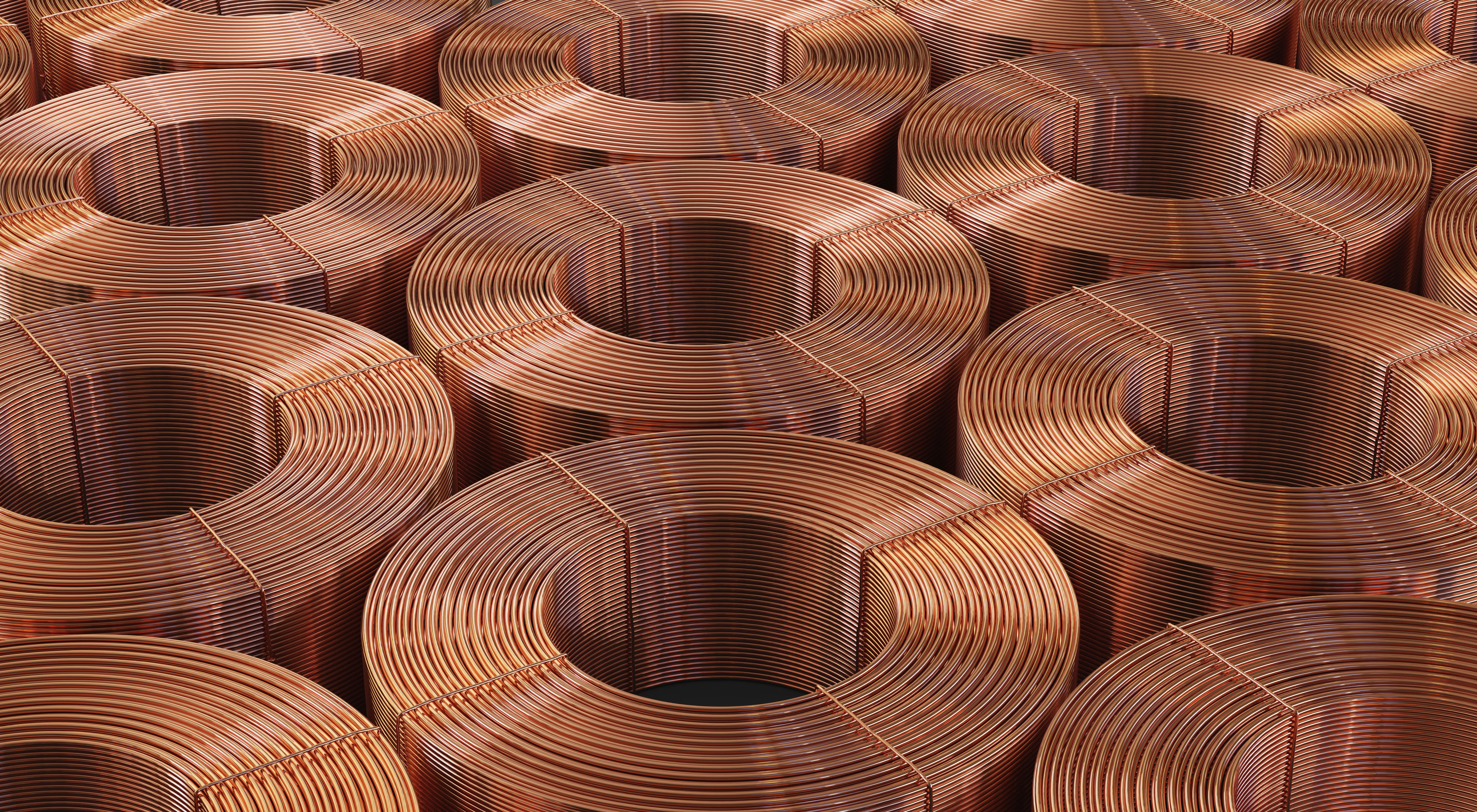

Ero Copper Set to Experience Step Change in Production Growth

Ero Copper's Positive Outlook on Production

Ero Copper (ERO) has recently raised its rating to Outperform at Raymond James, indicating an optimistic forecast for copper production growth and cash flows. However, the drop in shares is a concern as they have reacted negatively amid declining copper prices.

Implications of the Upgrade

- The upgrade suggests strong confidence in Ero Copper's operational capabilities.

- Investors should consider the market's reaction to falling copper prices.

Future Expectations

As the company positions itself for a step change in production, stakeholders are watching closely to see how effectively this outlook translates to performance against a backdrop of fluctuating market conditions.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.