Bitcoin Options Market Analysis: Unexpected Trends Defying Bearish Sentiment

Bitcoin Options Market Analysis

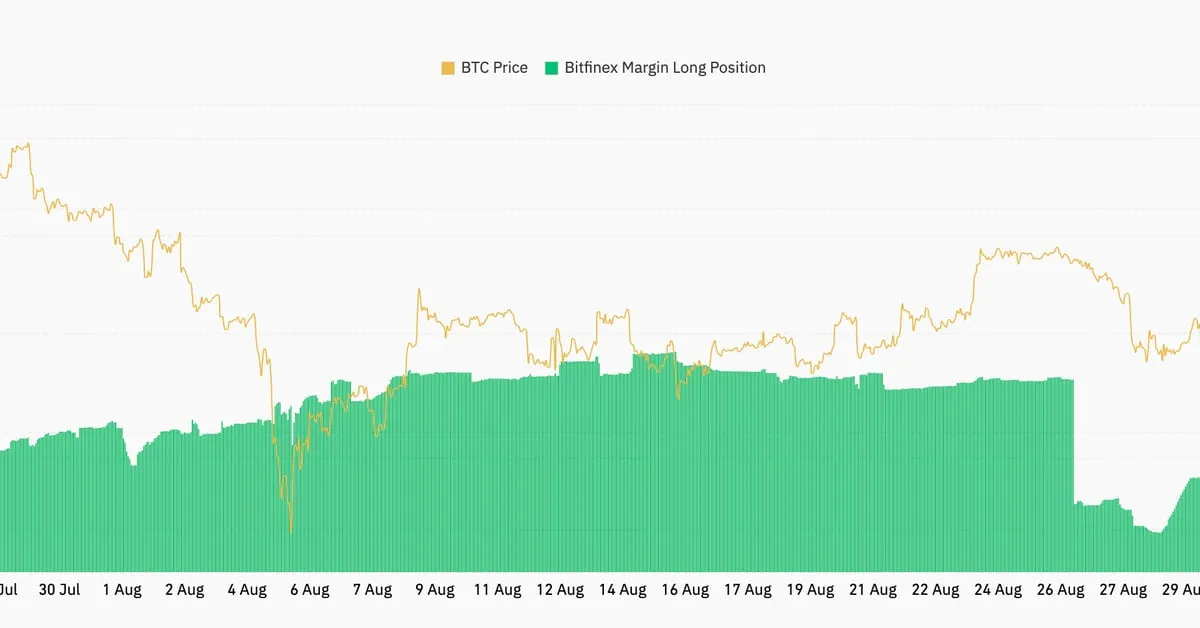

The latest analysis indicates that the Bitcoin options market is challenging the prevailing bearish sentiment. Since August 28, the number of margin longs on Bitfinex has surged significantly, with a net increase of approximately 3,000 BTC. This brings the total to nearly 64,350 BTC, demonstrating a robust interest in Bitcoin despite external pressures.

Current Market Insights

- Optimistic trends observed in Bitcoin margin longs.

- Options trading volumes are experiencing remarkable growth.

- Market sentiment appears to be shifting favorably.

Potential Implications

- Investors may reconsider their strategies based on this new landscape.

- Increased activity could influence future market dynamics.

- Traders need to be alert to rapid changes and shifts.

Overall, this analysis underlines the importance of staying updated with Bitcoin trends and considering the underlying factors affecting the markets.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.