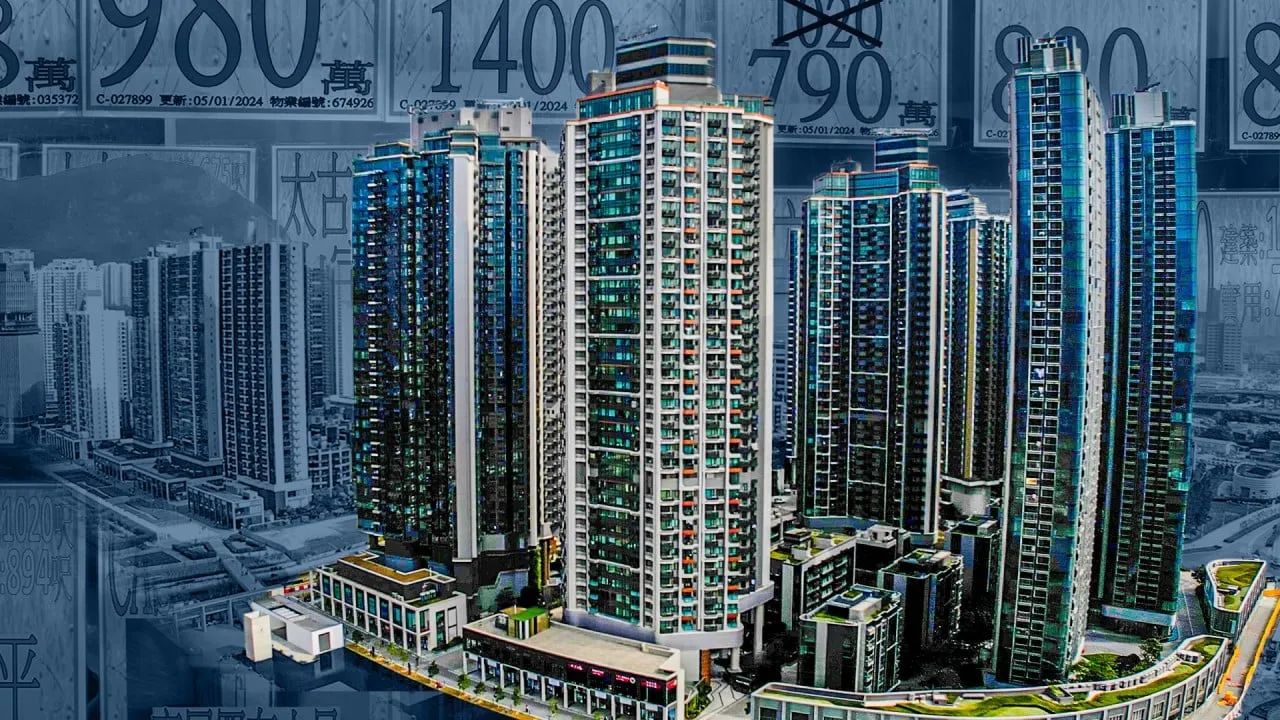

Hong Kong Property Transactions Decline to Lowest Levels in Six Months Amid Cooling Measures

Hong Kong's Market Faces Slump

Hong Kong's property market has taken a significant hit, with overall property transactions falling to the lowest point since February. The data shows a notable decline of 10% month-on-month, indicating a broader trend that has emerged since the government relaxed property cooling measures.

Transaction Insights

- Total property transactions reached just 4,729 units in August.

- Deal values fell by approximately 20% month-on-month to HK$34.3 billion.

- Home sales hit a six-month low, with only 3,654 units sold.

Derek Chan, from Ricacorp Properties, emphasizes that fluctuations in market sentiment influenced these sales trends, and warns that further property registrations will remain low until interest rates begin to decline.

Market Prediction

The market anticipates changes following potential rate cuts by the US Federal Reserve, which could lead to renewed activity in property transactions. Current interest rates in Hong Kong are at a 23-year high, leading developers to adjust their pricing strategies.

As the market braces for upcoming developments, analysts expect a slight increase in transactions for September, testing the 4,930 mark.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.