Exploring the SOXX ETF for Strategic Semiconductor Investment

SOXX ETF Overview

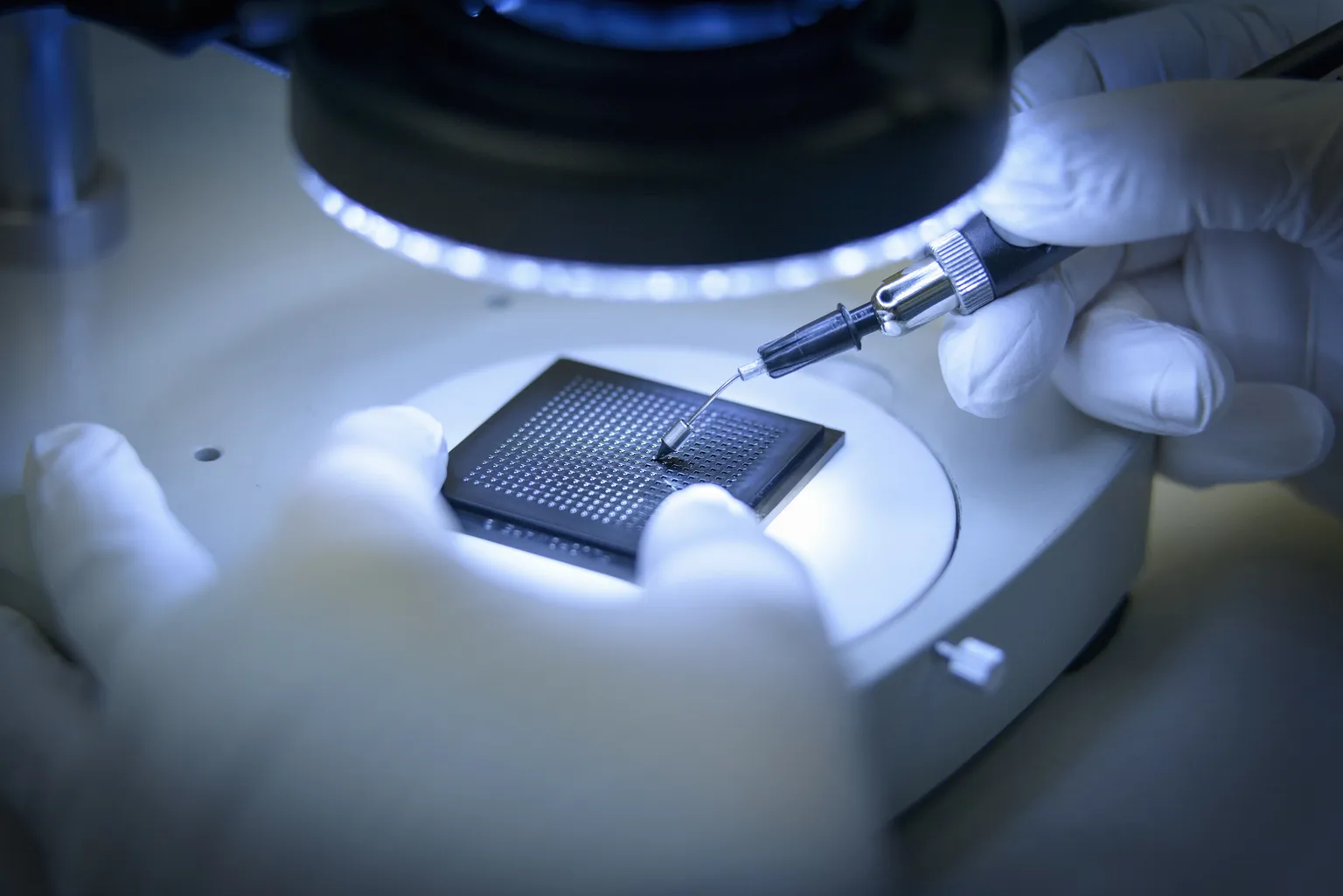

The SOXX ETF serves as a key player in the investment landscape, targeting the semiconductor industry. This fund comprises leading entities that drive the sector's growth, thus providing investors with significant market insights. Despite potential risks associated with high concentration, SOXX strikes a balance with its diversified holdings.

Key Features of SOXX ETF

- Broad Exposure: Investors benefit from a wide array of semiconductor companies.

- Concentration Risks: Be aware of risks but note the fund's diversification strategies.

- Top Companies: Focuses on industry leaders, enhancing potential returns.

Investment Strategies

When considering the SOXX ETF for your portfolio:

- Assess Market Trends: Keep an eye on semiconductor market forecasts.

- Diversify Further: Consider additional sectors for a balanced investment.

- Review Holdings Regularly: Stay updated on fund performance and sector developments.

Final Thoughts on SOXX ETF

This fund is a noteworthy option for those looking to capitalize on the growing semiconductor market. By providing decent diversification and targeting industry leaders, SOXX ETF could enhance your investment strategy significantly.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.