News: The Controversial Shift of Defense Stocks in ESG Portfolios

News: Understanding the Shift in Defense Stocks

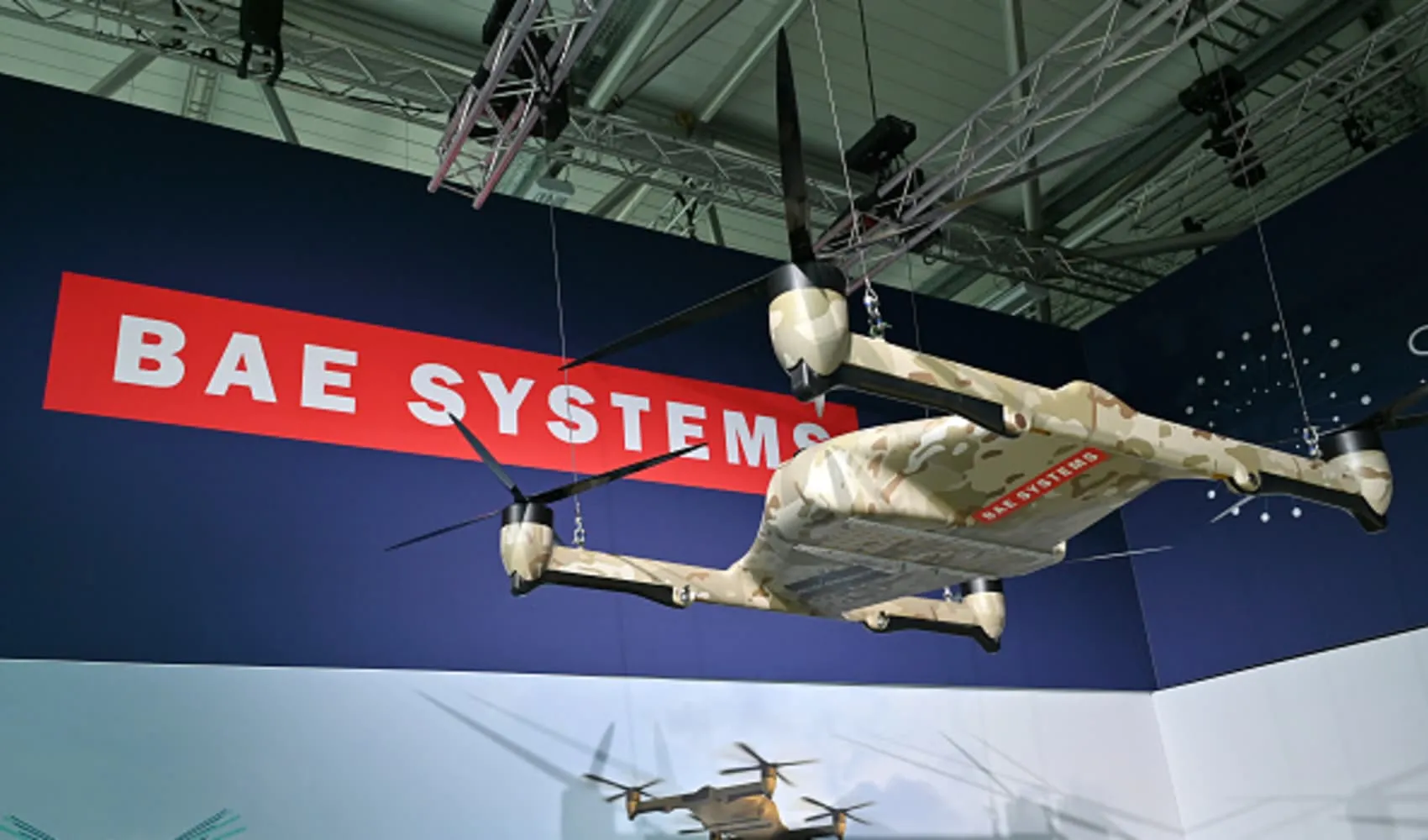

As the war in Ukraine persists, fund managers are reassessing defense stocks in light of sustainable investing principles. This movement signals notable changes in investment strategies, blending traditional defense spending with ESG factors.

Trends Affecting Defense Stocks

- Increased Spending: Governments are expected to ramp up defense budgets.

- Investor Sentiment: Shifts in public opinion may affect stock valuations.

- Long-term Impact: Defense stocks could see sustained interest in ESG portfolios.

Opportunities and Risks

This evolving landscape presents both opportunities and potential risks. Investors must weigh the moral implications against the financial returns that defense equities can offer in a turbulent geopolitical context.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.