China's Largest Banks See Profit Declines as Property Sector Pressures Profitability

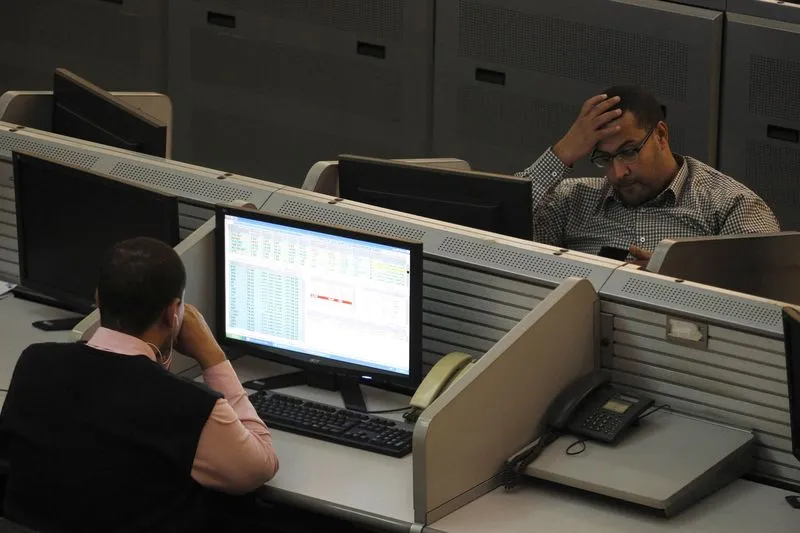

China's Banking Sector Faces Profit Challenges

Four of China's five largest banks have announced a downturn in profit for the second quarter, attributing the decline to ongoing struggles in the property sector.

Government Intervention and Lending Rates

In an effort to stimulate a sluggish economy, the Chinese government has nudged banks to lower lending rates. However, this strategy has yet to bolster loan demand effectively. This raises concerns about the long-term viability of these banks as they deal with falling profits amid rising economic pressures.

Impact of the Property Sector

The property sector, a critical pillar of China's economy, has been facing considerable strain. As defaults and financial difficulties mount, banks are compelled to reassess their lending strategies and address rising credit risks.

Future Outlook for China's Banks

With ongoing economic uncertainty, the outlook for China's banks remains cautious. Stakeholders are advised to monitor how these institutions adapt to the changing landscape.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.