PCE Inflation Trends and Recession Risks: Analyzing the Low Probability of a Soft Landing

Saturday, 31 August 2024, 12:42

PCE Inflation Trends and Recession Risks

As the latest PCE data emerges, many analysts argue that inflation remains persistent. This raises questions about the Federal Reserve's potential moves and the implications for the overall economy.

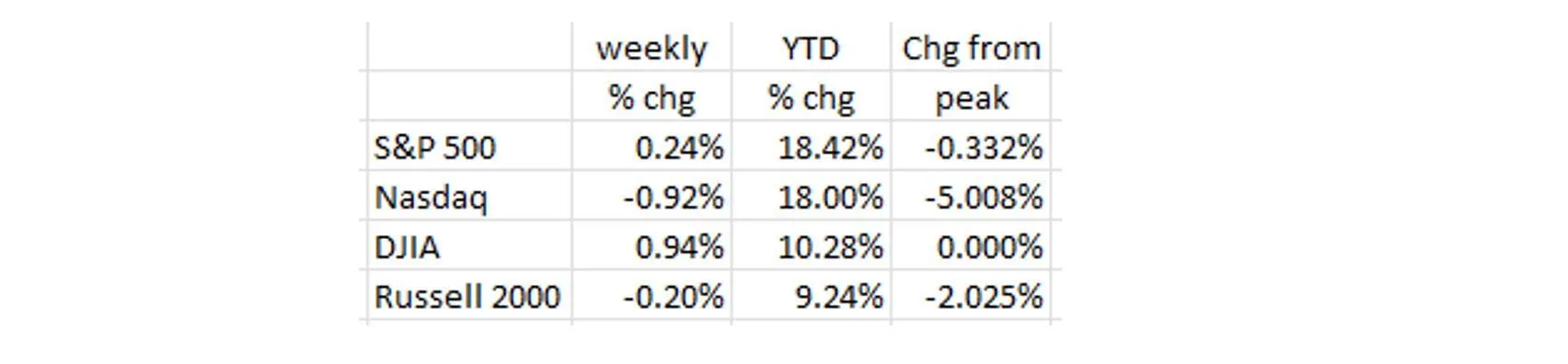

The Impact on the Equity Market

- Many expect the equity market to continue oscillating as tech stocks face pressure.

- Investor sentiment is complicated by fluctuating home sales figures and rising credit card delinquencies.

Key Economic Indicators

- PCE inflation rates are often a lagging indicator.

- Employee workweek data suggests a tightening labor market.

- Increasing unemployment claims raise further concerns.

In summary, the combination of PCE inflation trends and current economic indicators suggests a low probability of a soft-landing scenario.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.