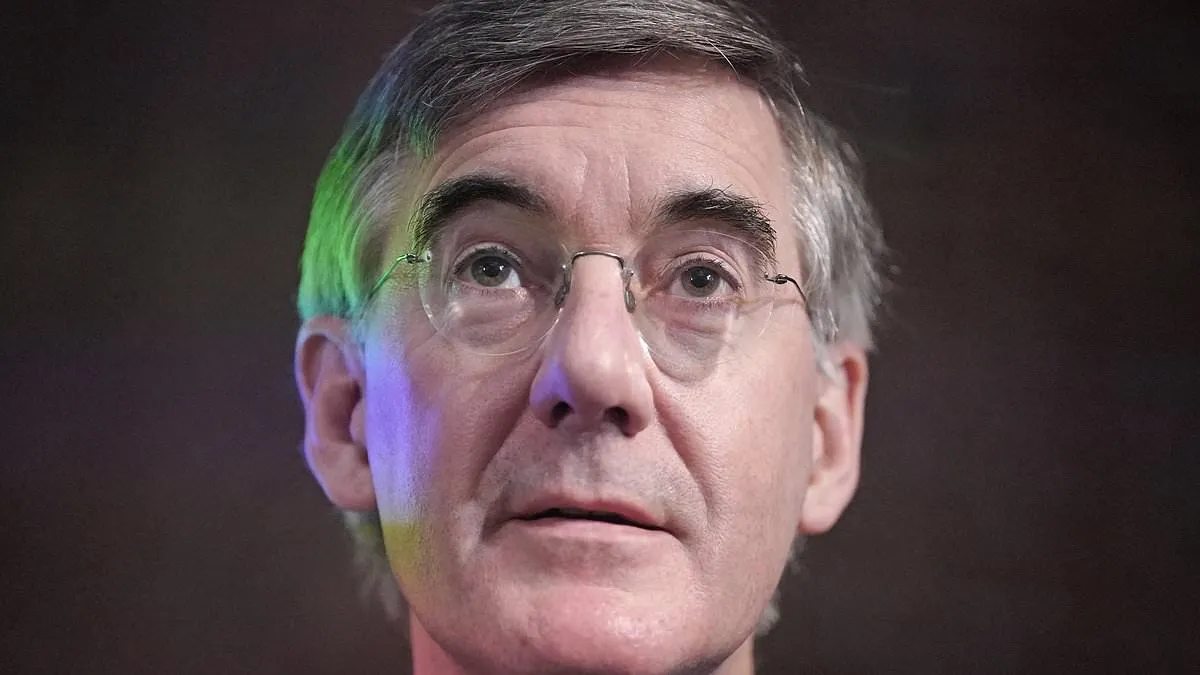

DailyMail Reports £4M Money Markets Payout for Jacob Rees-Mogg

Understanding Jacob Rees-Mogg's Payout

The recent news from DailyMail about Jacob Rees-Mogg sharing a staggering £4M payout raised eyebrows across the financial sector.

Details of the Money Markets Event

This payout stems from the closure of Somerset Capital, a firm co-established by Jacob Rees-Mogg, Edward Robertson, and Lord Johnson in 2007. The implications of this closure resonate beyond just individual finances - it reflects on broader money markets.

- Financial scrutiny around the firm's practices.

- Interest in market reactions to such significant payouts.

- The legacy of Somerset Capital and its impact on investments.

Implications of the Closure

The ramifications of this closure extend into public perception of financial ethics. Critics argue over how such large payouts align with market integrity.

- Potential benefits to Rees-Mogg's reputation.

- Risk factors involving investor trust.

For a comprehensive outlook on the event and its implications in the financial landscape, visit the source.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.