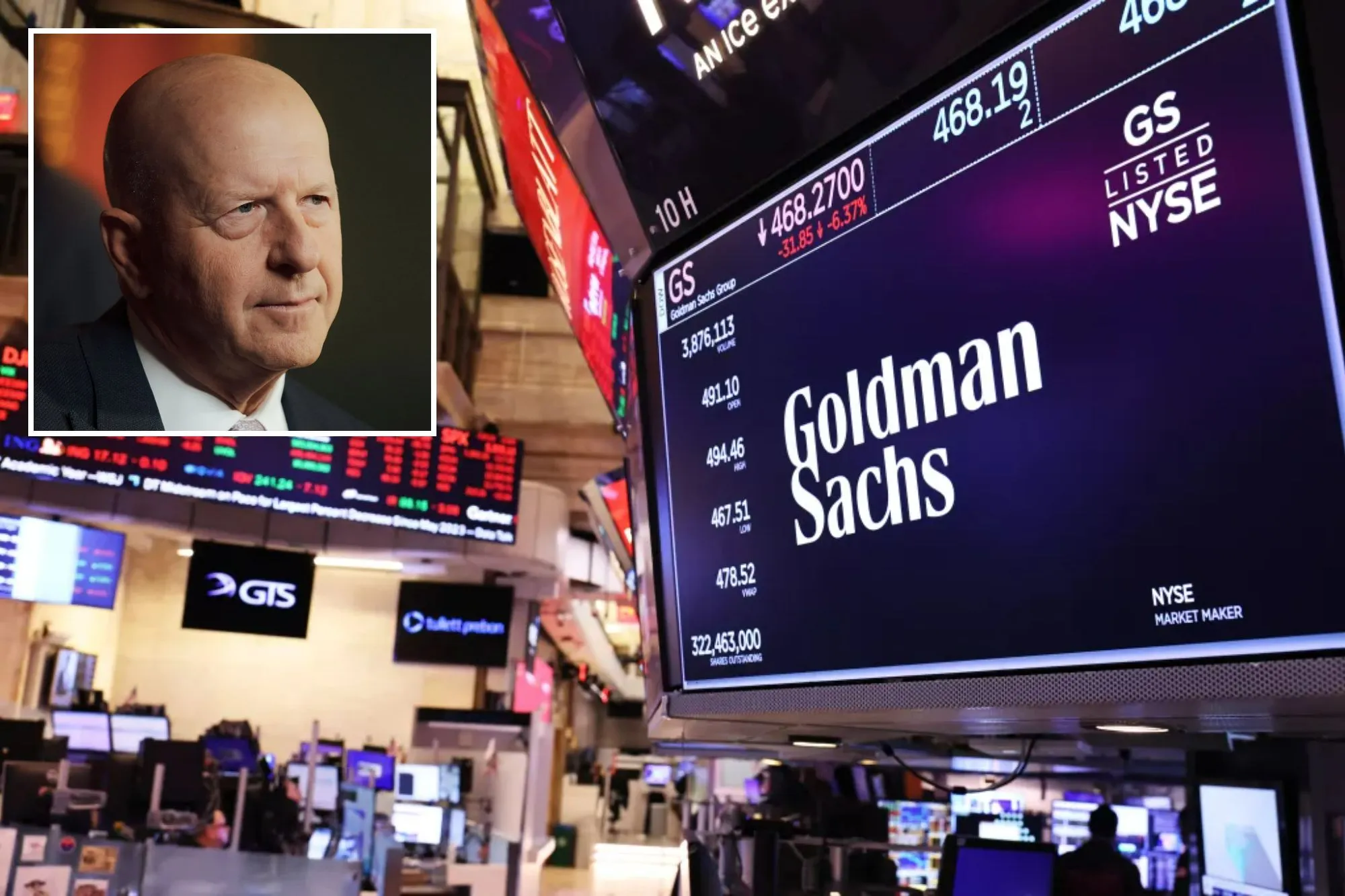

Goldman Sachs Job Cuts Impacting Business and Investments on Wall Street

The State of Goldman Sachs

Goldman Sachs has recently revealed plans to terminate over 1,300 positions, aligning with its strategy to reassess banking bonuses and improve overall business performance. As one of the most notable names on Wall Street, this decision could signal a broader trend affecting job security within the banking sector.

Impact on Bonuses and Investments

The adjustments made by Goldman Sachs raise questions about future banking bonuses and the company’s investment strategies. With the financial landscape evolving, it remains crucial for banking giants to reconsider their operational effectiveness.

- Significant job losses across the firm

- Potential reductions in bonus structures

- Shifts in overall investments from the banking sector

Conclusion: A New Era on Wall Street

These developments at Goldman Sachs indicate a need for financial institutions to adapt swiftly to market changes and emerging economic realities. With Wall Street under continuous scrutiny, firms must balance performance and employee welfare.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.