DailyMail Money: First Time Buyers and Falling Mortgage Rates

Understanding the Impact of Falling Mortgage Rates

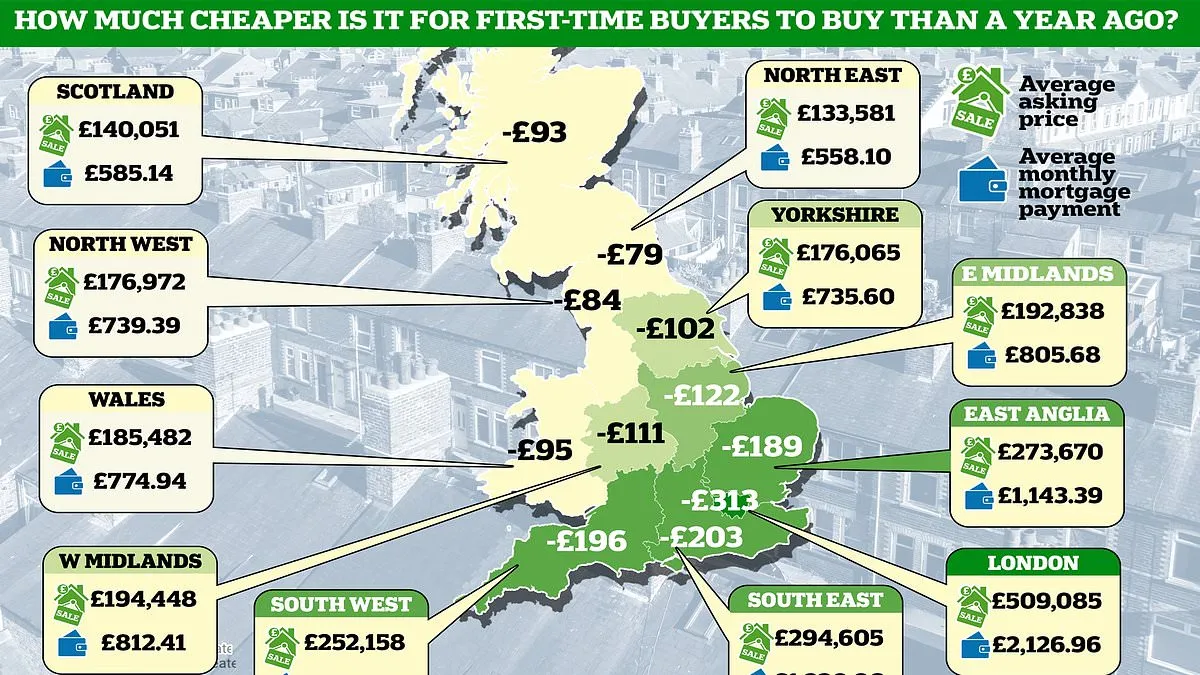

The recent decline in mortgage rates has led to a notable shift in the housing market, particularly benefiting first time buyers. Monthly mortgage payments have dropped significantly to £949 from £1,096 last July, creating attractive opportunities for those entering the housing market. This trend highlights the importance of staying informed on money management and financing options.

Opportunities for First Time Buyers

- Lower Mortgage Payments: New figures illustrate a decrease, allowing buyers to save on costs.

- Enhanced Market Conditions: A favorable economic environment promotes purchasing.

- Strategic Investment: Savvy buyers can capitalize on current trends.

Current Market Insights

As the housing market evolves, those considering homeownership should assess their financial positions carefully. With rates at a historic low, first time buyers have an unprecedented chance to secure a mortgage. Consulting with financial advisors and exploring various options is crucial for maximizing benefits.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.