Maximize Your Money with Falling Mortgage Rates: Insights for First Time Buyers

Analyzing Falling Mortgage Rates

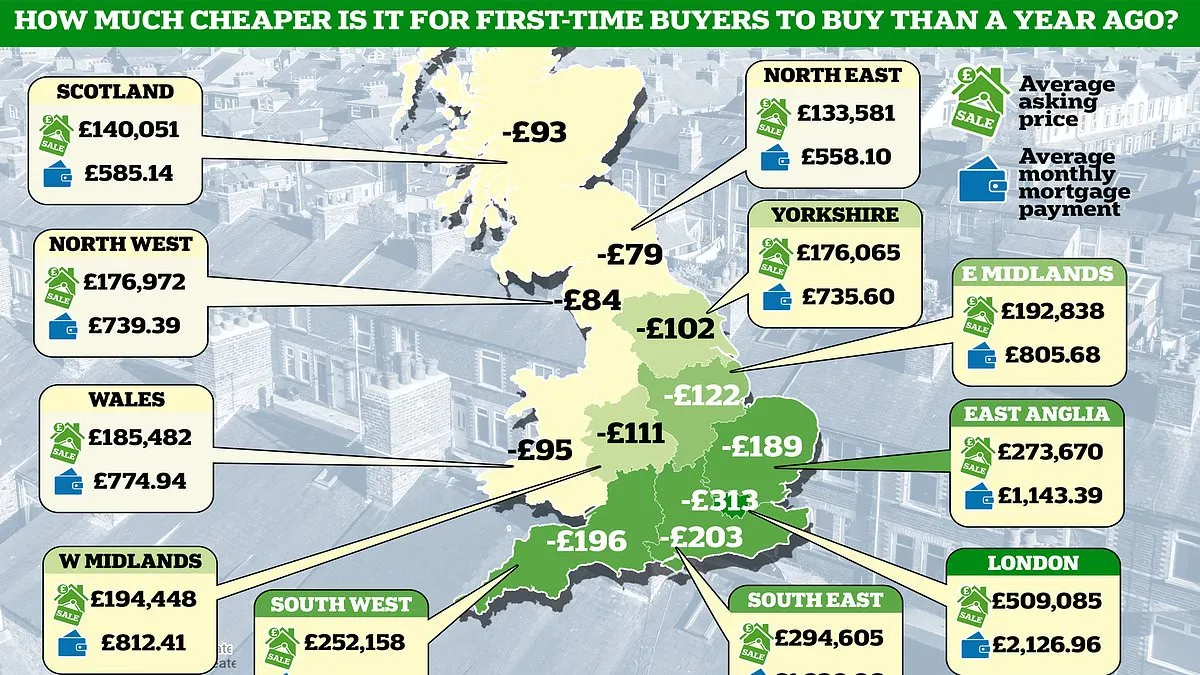

Recent trends indicate that first time buyers are increasingly capitalizing on declining mortgage rates. The average monthly mortgage payment has dropped to £949 compared to £1,096 last July, providing more financial flexibility for potential homeowners.

Opportunities for Home Buyers

This decrease in rates not only alleviates some pressure on budgets but also enhances buying power. Buyers are now exploring better property options as affordability improves. Home buying sentiment is shifting with more individuals ready to invest.

- Increased Affordability

- Greater Selection of Properties

- Market Dynamics Shift

Future Trends in the Market

As the housing market adapts, potential buyers must stay informed and ready to seize investment opportunities that arise from these changes.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.